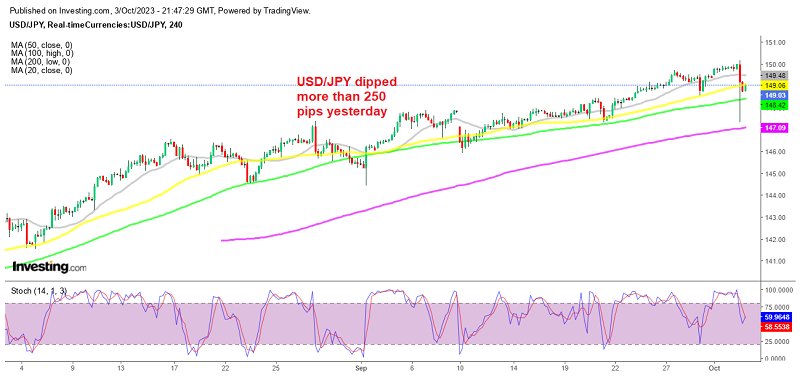

USD/JPY Dives on BOJ Intervention after Reaching 150

USD/JPY recovered from the 25 cent crash last year and it reached the major milestone of 150 now, where the BOJ intervened

USD/JPY has been rallying higher throughout this year, since it bottomed in January below 128, following the Bank of Japan intervention and a retreating period in the USD at the end of last year. Since then, this pair has gained more than 20 cents, with buyers remaining in total control, even during times when the USD has been retracing lower.

The Bank of Japan meeting last Friday didn’t produce much, as it failed to meet market expectations after comments from Kazuo Ueda, governor of the Bank of Japan, who stated that the central bank may abandon its negative interest rate strategy, fueling the uptrend on this pair even further. They didn’t comment on intervention which weakened the JPY and sent this pair higher.

The Bank of Japan has kept bond yields negative in order to boost inflation and growth, while other major central banks have raised rates to multi-year highs, resulting in the JPY being used as a loan currency against a range of other high-yielding currencies, including the USD. The significant interest rate differential between the Federal Reserve and the Bank of Japan is the primary driving force behind this current surge.

Besides the rate differential and the BOJ policy, Japan’s latest economic data has been dismal. The current Japanese wage figures revealed a deceleration in pay growth, something the BoJ is particularly concerned about, while the Tokyo CPI, which is seen as a leading indicator for national CPI, continues to decline while being over the Bank of Japan’s objective.

So, this pair has been pushing higher and yesterday it finally reached the major level at 150, which is an alarm bell for the Bank of Japan. They haven’t been too vocal about intervention recently so the JPY was at the mercy of the BOJ and yesterday we saw an intervention in the forex market by them, which sent this pair to 147.35 according to my broker’s feed. But, it already recuperated most of the losses by the end of the day, so the uptrend still remains intact.

USD/JPY Live Chart

USD/JPY- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account