Forex Signals Brief October 11: Producer Inflation Forerunning the CPI Tomorrow

Today we will see the PPI producer inflation report from the US for September, before we get the US CPI consumer inflation report tomorrow

Yesterday’s Market Wrap

The economic calendar was light and the markets were quiet yesterday again. The instability in the Middle East was quickly forgotten by markets, as seen by the European trading that occurred. European equities were all up by around 2% as they tried to catch up to Wall Street’s gains from Monday. This occurred as 10-year Treasury rates continued to retreat lower from the highs printed on Thursday last week. It’s a simple reversal of the anxieties that accompanied the automatic response, but further doubts may surface in the coming weeks.

Regarding foreign exchange, the USD was initially flat prior to the tight ranges being extended. As risk transactions progressed, the value of the dollar slipped while most other assets benefited and had the fifth day of gains in a row. As a result, the US dollar continued to retreat.

The US September NFIB small business optimism index posted a slowdown to 90.8 points from 91.3 points in August, while China reportedly is weighing new stimulus and the higher deficit to meet the growth targets. Now markets are back to the regularly scheduled programming, so we’ll be concentrating on the US CPI statistics that will be released later this week.

Today’s Market Expectations

Today the economic calendar for Asia and Europe is very light again, although we have some important releases in the North American session. First comes the producer inflation report. The MoM figure is expected to slow down to 0.3% compared to the previous reading of 0.7% from August, while the US PPI Y0Y is anticipated to remain at 1.6%. Core CPI MoM is seen remaining stable at 0.2% vs. 0.2% in August, while Core PPI Y0Y is anticipated to tick higher to 2.3% from 2.2% prior. Given that the market is expected to be more focused on the CPI data the next day, this news may not move the market as much.

Markets often react when the FOMC Meeting Minutes are released, but these changes normally fade quickly because the information is already three weeks old and widely known. Recall that the Fed revised up its growth and inflation predictions and lowered its unemployment rate, leaving the FFR at 5.25–5.50% as anticipated. According to the Dot Plot, the FOMC is still projecting a 25 basis point increase by year’s end, but “surprisingly” only anticipates 50 basis points of rate decreases in 2024, down from 100 basis points earlier.

Forex Signals Update

Yesterday the price action was slow again with the USD retreat continuing further, although it lost pace. It seems like traders are waiting for tomorrow’s CPI inflation report. We opened several trading signals yesterday, although only three closed, with two being winning forex signals and one hitting SL once again.

GOLD Stabilizing Around $1,860

Gold has been reaching lower highs since May. The downturn intensified in late September when it started to tumble and lost over $140. Gold fluctuated in price, peaking at about $1,830, even though a support zone had formed above $1,810. However, the Middle East tensions that flared up over the weekend have reduced risk sentiment in the financial markets, which is helping gold. On the H4 chart, it started with a bullish gap higher yesterday night and has now crossed above $1,850, with the 50 SMA (yellow) serving as support. Therefore, even if gold is bullish right now, we’re looking for a good place to start a long-term sell Gold signal once things have settled down.

XAU/USD – Daily chart

- Gold Sell Signal

- Entry Price: $1,865

- Stop Loss: $1,880

- Take Profit: $1,825

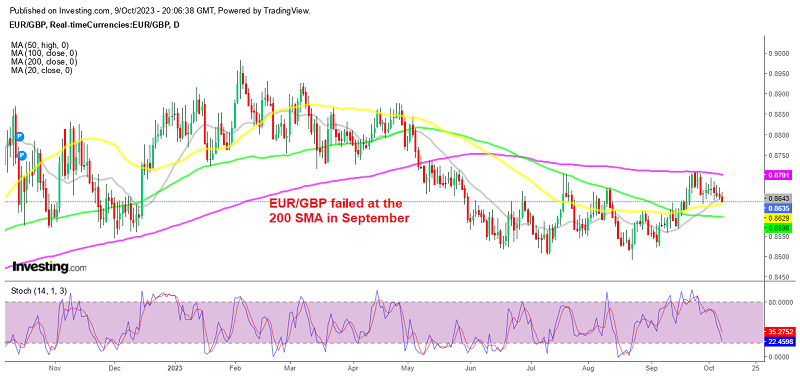

Remaining Long on EUR/GBP at the 50 Daily SMA

EUR/GBP pair has been under pressure for about a week after the Eurozone’s consumer expenditure statistics slowed down at a faster rate in August as rising inflation squeezes families’ real income. The pair is looking to fall further as investor confidence in the Eurozone economy dwindles owing to an unclear economic outlook.

So, the negative data keeps accumulating for the Euro and this pair failed to push above the 200 SMA (purple) last week after being slightly bullish in September. Now, after the rejection at that moving average, EUR/GBP has reversed back down and is facing the 50 SMA (yellow) on the daily chart. Later on Thursday the UK GDP report is expected to show a return to growth in August after the 0.5% contraction in July which would be welcomed by GBP buyers, but there’s s time until then so let’s see.

EUR/GBP – Daily chart

Cryptocurrency Update

The 200 SMA Continues to Reject BITCOIN

Bitcoin has been slowly climbing since it bottomed out just around $25,000, and the cryptocurrency market has recently undergone another surge. Buyers failed to break above moving averages such as the 100 SMA (green) and the 200 SMA (purple) on the daily chart, and we saw a bearish candlestick. Buyers are on their way, and the price is returning to the moving averages, so we should see a break above soon.

BTC/USD – Daily chart

- BTC Buy Signal

- Entry Price: $26,248.2

- Stop Loss: $24,500

- Take Profit: $28,000

ETHEREUM Testing the Downside Again

Late last month, the price of Ethereum began to rise off its support level, indicating that there was some purchasing interest and demand for Ethereum at around $1,600. Buyers have repeatedly entered the zone above this level, but the 100 SMA (green) has served as resistance on the daily chart. Following Sunday’s advance, we had a reversal at this moving average, which wiped out all of September’s gains.

ETH/USD – Daily chart

- ETH Buy Signal

- Entry Price: $1,671.79

- Stop Loss: $1,371

- Take Profit: $1,971

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account