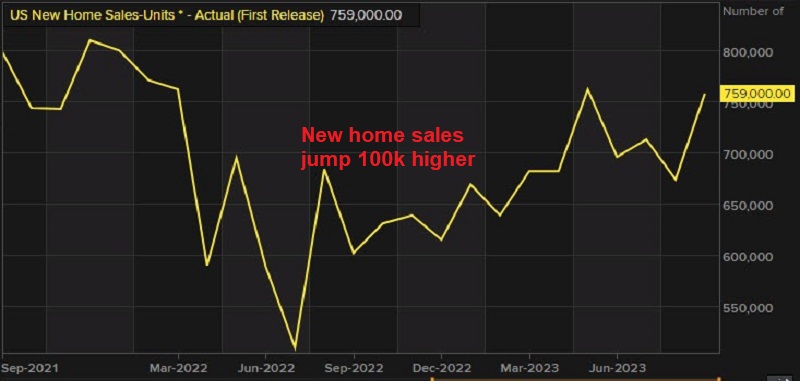

US Housing Sector Shows Resilience Too as Home Sales Jump Higher

Yesterday we saw a reversal higher in New Home Hales in the US, while today Pending Home Sales jumped to a 19.-month high

The Federal Reserve has been raising interest rates at the fastest pace ever, which has been keeping the USD bullish, but is also a burden for home buyers, since it increases the monthly payments as mortgage rates go higher.

We saw a slowdown earlier this year in US home sales, but this week’s figures for pending home sales and new home sales have been stronger than expected, showing that this sector is not suffering too much from higher interest rates. This should be positive for the USD in the mid-term so we’re keeping the bullish bias for the buck against most major currencies.

Sales of new single-family houses in the United States reached a 19-month high in September, owing to dropping median house prices. According to Reuters, the yearly median house price fell by the most since 2009, owing primarily to incentives made by builders to entice buyers.

However, increasing mortgage rates reaching 8% might potentially dampen demand, despite a chronic lack of previously owned homes driving purchasers to new development. According to the Commerce Department, the majority of properties sold in September were priced between $150,000 and $499,999.

US New Home Sales for September 2023

- New-home sales for September 0.759M vs 0.680M estimate.

- Prior month 0.675M revised to 0.676M

-

Sales of new single-family houses in September 2023:

- Seasonally adjusted annual rate: 759,000 vs 680,000 est.

- Increase of 12.3% from the revised August rate of 676,000

- Increase of 33.9% from September 2022 estimate of 567,000

-

Sales Price for new houses sold in September 2023:

- Median sales price: $418,800

- Average sales price: $503,900

-

For Sale Inventory and Months’ Supply:

- Seasonally adjusted estimate of new houses for sale at the end of September: 435,000

- Represents a supply of 6.9 months at the current sales rate

The numbers are based on signed contracts.

Pulte group said yesterday that homebuilders (including themselves) were buying down the mortgage rate to stimulate new home sales.

Pending Home Sales for September 2023

- Pending home sales for September 1.1% versus -1.8% expected

- Pending home sales in August were -7.1%

- Pending home sales up 1.1% versus -1.8% expected

- Pending home index rose to 72.6 points from 71.8

Looking at the different regions

- Northeast PHSI decreased by 0.9% to 62.6, marking an 18.2% reduction from August 2022.

- Midwest index dropped by 7.0% to 71.3, down 19.1% from the previous year.

- South PHSI fell by 9.1% to 86.5, showing a 17.6% dip from the prior year.

- West index retreated by 7.7% to 56.3, sinking 21.4% compared to August 2022.

From Lawrence Yun, NAR Chief Economist:

- “Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers.”

- “Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

- “It’s clear that increased housing inventory and better interest rates are essential to revive the housing market.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account