USD Ends Lower After Better ADP and JOLTS Jobs Numbers

The USD was making some gains yesterday in the US session but it has turned bearish today despite better ADP jobs figures

Following the release of ADP statistics and the quarterly refunding announcement, the picture has been mixed. Both placed downward pressure on yields, which helped to support the AUD/USD, although the currency is rising elsewhere. Cable has broken through yesterday’s low of 1.2120 and seems to be locked at 1.20 forever.

Construction spending, JOLTS, and ISM manufacturing statistics were also just released, with the FOMC decision coming later in the evening. The employment reports such as the ADP which is listed below and the JOLTS job openings posted some decent figures, showing that this sector is in good shape. Although, ISM manufacturing fll deeper into contraction, which has left the USD bearish for now.

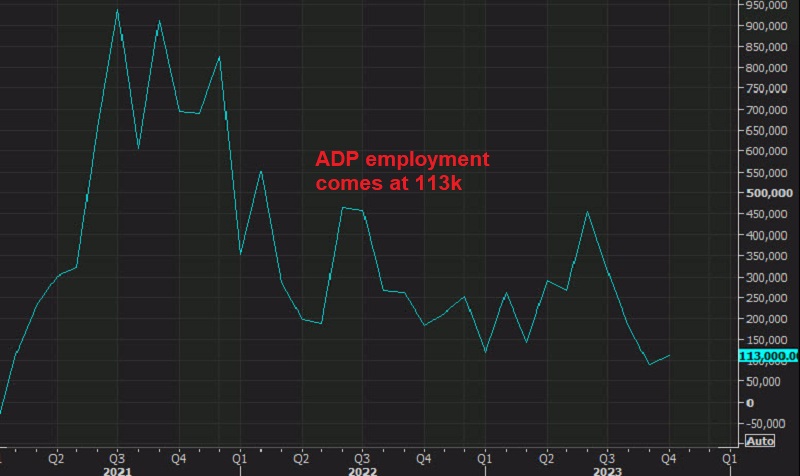

October 2023 Employment Report from ADP

- ADP US October employment +113K vs +150K expected

- September ADP employment was +89K

Details:

- small (less than 50 employees) +19K vs +95K prior

- medium firms (500 – 499) +78K vs +72K prior

- large (greater than 499 employees) +18K vs -83K prior

Changes in pay:

- Job stayers 5.7% vs 5.9% prior

- Job changers 8.4% vs 9.0% prior

“No single industry dominated hiring this month, and big post-pandemic pay increases seem to be behind us,” said Nela Richardson, chief economist, ADP. “In all, October’s numbers paint a well-rounded jobs picture. And while the labor market has slowed, it’s still enough to support strong consumer spending.” The US dollar is softer after the data.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account