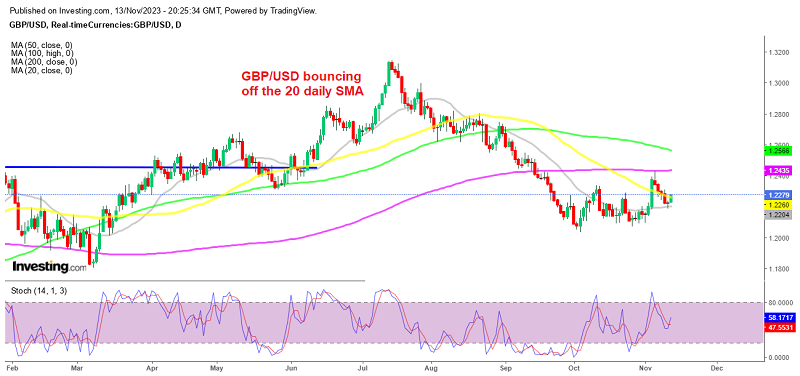

GBP Buyers Trying Again After Friday’s Doji Daily Candlestick

GBP/USD turned bearish from July until the beginning of October, with the price approaching 1.20, but sellers didn't quite get there. The U

GBP/USD turned bearish from July until the beginning of October, with the price approaching 1.20, but sellers didn’t quite get there. The UK economy is in recession which has been keeping the GBP soft, but nonetheless, this pair formed a bottom in October, trading in a range during most of last month, and generated a strong positive reversal this month. Buyers failed the first attempt at the 200 SMA last week, but they’re having another go at the upside after the price formed a doji candlestick on Friday.

yesterday we saw a strong bullish move, as the USD followed the bearish reversal in Treasury yields. Earlier this month we saw a strong surge which sent this pair around 350 pips higher, especially following the FED’s meeting, which did not imply another rate rise in the near future. but the 200 SMA (purple) turned into resistance at the top and rejected the price.

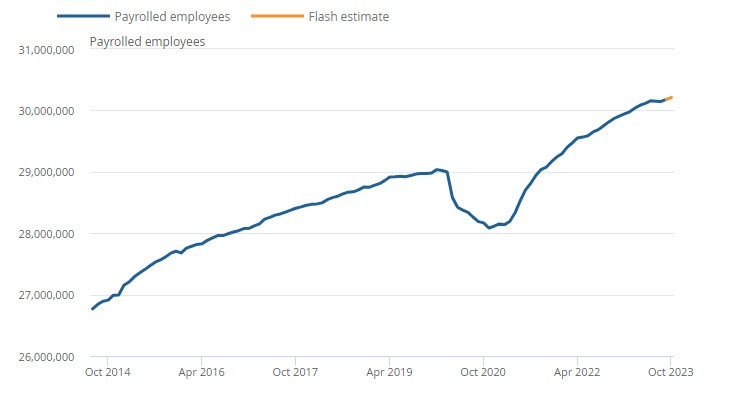

Today we had the employment report from Britain with the unemployment rate expected to remain the same at 4.2% in October after ticking lower in September, while earnings are expected to cool off to 4.7% from 8.1% previously.

UK October Employment and Earnings Report

- October payrolls change 33k vs -11k prior

- Prior -11k; revised to 32k

- September ILO unemployment rate 4.2% vs 4.3% expected

- Prior 4.2%

- September employment change +54k vs -198k expected

- Prior -82k

- September average weekly earnings +7.9% vs +7.4% 3m/y expected

- Prior +8.1%; revised to +8.2%

- September average weekly earnings (ex bonus) +7.7% vs +7.7% 3m/y expected

- Prior +7.8%; revised to +7.9%

The good news here is that UK labour market conditions are seen holding up in this latest snapshot, although there are some caveats to the data as noted before. The jobless rate remains steady while wages data continue to run strong and the latter will keep the BOE on their toes in possibly needing to tighten further down the road.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account