Markets Remain Uncertain, Gold Surgs After Higher Unemployment Claims

Today the unemployment claims report came higher again, showing that there are fractures appearing in the US weekly employment figures.

Written by:

Skerdian Meta

•

Thursday, November 16, 2023

•

2 min read

•

Last updated: Thursday, November 16, 2023

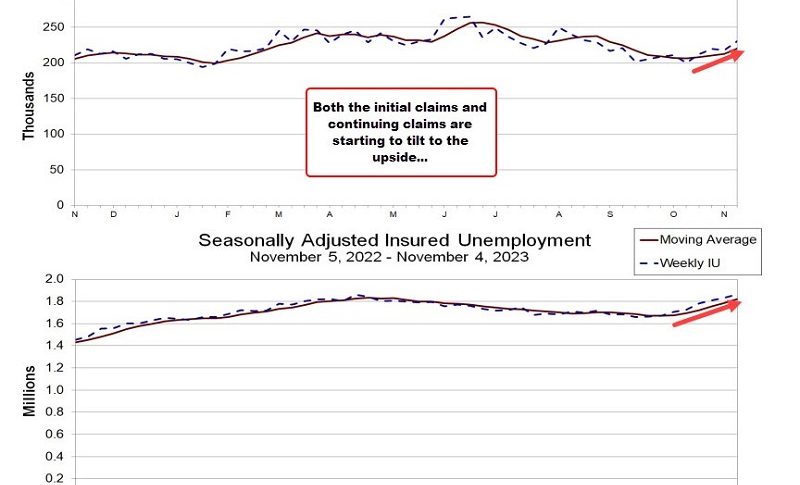

Today the unemployment claims report came higher again, showing that there are fractures appearing in the US weekly employment figures. Both initial and ongoing claims are beginning to trend upward. Rates are lower following the release of the data, with the two-year down -6.6 basis points at 4.850%. The 10-year Treasury note is down 6.6 basis points to 4.472%. The unemployment claims trend has turned higher recently

The unemployment claims trend has turned higher recently

It has been a pretty calm day, with markets trading more sideways after the large changes on Tuesday. Major currencies are not displaying much hunger, while commodity currencies are behind due to a little drop in risk appetite late in the day. The AUD/USD and NZD/USD were already major laggards, but as oil prices fall somewhat, the loonie is also behind as we approach North American trade later.

AUD/USD is down 0.4% at 0.6478 as sellers prepare to counter a potential technical breakout this week. Meanwhile, the New Zealand dollar is down 0.8% to 0.5975 as the kiwi struggles to get any impetus throughout the session. This is amid an initial subdued mood in markets, as US futures now shift marginally lower on the day. Elsewhere, the dollar continues stable, with USD/JPY little changed at 151.30 and GBP/USD presently down 0.2% to little under 1.2400.

Treasury rates are marginally lower in the bond market as the push and pull from Tuesday’s drop continues. 10-year rates are down slightly more than 3 basis points, remaining around 4.50% for the time being. It’s a mixed bag out there, with traders and investors still trying to figure out what to make of the current swings and a lack of follow-through since Tuesday’s activity.

The Weekly US Initial Jobless Claims in Continuing Claims Data

- Initial jobs claims 231K vs 220K estimate. Highest since August 18

- Prior week unemployment claims were 217K

- 4-week moving average 220.25K vs 212.50K last week.

- Continuing claims 1.865M vs 1.847M estimate. Highest since November 2021

- Prior week continuing claims 1.834M were revised to 1.833M

- 4-week moving average of continuing claims 1.823M vs 1.789M

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

The unemployment claims trend has turned higher recently

The unemployment claims trend has turned higher recently

The unemployment claims trend has turned higher recently

The unemployment claims trend has turned higher recently