EUR/USD Trades Near the Top After the Final Eurozone CPI Inflation Numbers

During November the Euro has been showing some resilience, as buyers try to reclaim some of the losses, with the USD retreating lower. On Tu

During November the Euro has been showing some resilience, as buyers try to reclaim some of the losses, with the USD retreating lower. On Tuesday we saw a 200 pip surge in this pair after the soft US inflation report, but in the last two days EUR/USD found itself in a difficult balancing act amid the volatile atmosphere of the foreign currency market due to uncertainties.

Following the miss in the US CPI report, the EUR/USD broke above the critical barrier around the 1.0760 level on the daily chart. The price has been slightly stretched, as indicated by the distance from the blue 8 moving average. Generally, we may expect a retreat into the moving average or some consolidation before the next advance in such cases.

A rebound in US Dollar demand after the US retail sales came better than expected on Wednesday has put downward pressure on the pair, as the Dollar Index rises to 104.50, up from a multi-month low of 104.00. The Euro closed the day around 1.0850, indicating a 0.05% drop for the day.

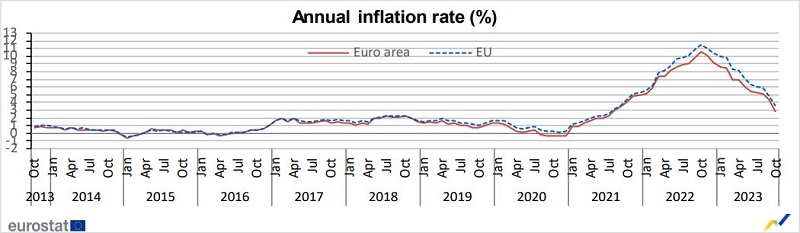

Although the Eurozone’s economic environment looks to be worse, with September Industrial Production showing a 1.1% monthly reduction, a sharper drop than the previous month’s increase. Annual production fell by 6.9%, aggravating the Euro’s weakness versus the US dollar. Inflation remained lower in Europe last year and has also been cooling off too, as shown below.

Eurozone Final CPI Inflation Report

- October final CPI YoY +2.9% vs +2.9% prelim

- Prior headline CPI was +4.3%

- Core CPI YoY +4.2% vs +4.2% prelim

- Prior +4.5%

No changes to the initial estimates as euro area inflation is seen easing further in October. But with core annual inflation still sitting just above 4%, it is no time to be complacent.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account