EUR/USD Retreating Despite Slight Improvement in PMI Figures

EUR/USD turned bullish early last month, but the uptrend really picked up pace this month, as the FED has softened the rhetoric, indicating

EUR/USD turned bullish early last month, but the uptrend really picked up pace this month, as the FED has softened the rhetoric, indicating that they won’t raise interest rates again. However, the FED minutes from the November 1 policy meeting allowed the USD to regain a foothold late Tuesday which continued yesterday. Policymakers agreed that further policy tightening would be justified if progress toward the inflation target was insufficient.

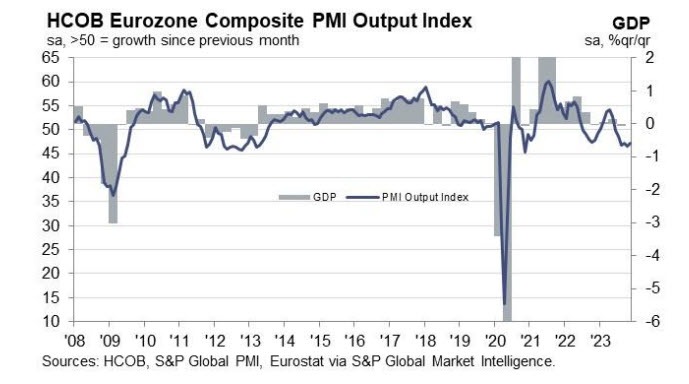

That sent EUR/USD down after reaching its highest level since early August above 1.0950 on Tuesday and ended the day in the red. The pair remained on the back foot during most of the day yesterday, trading in negative territory below 1.0900 after falling to 1.8050 lows. Today we had the manufacturing and services reports from Europe, which showed that both sectors remain in contraction and the Euro has nothing going for itself, which should keep this pair bearish once the USD weakness is over.

Eurozone November Services Report

- November flash services PMI 48.2 points vs 48.1 expected

- October services PMI was 47.8 points

- Manufacturing PMI 43.8 points vs 43.4 expected

- Prior manufacturing was 43.1 points

- Composite PMI 47.1 points vs 46.9 expected

- Prior composite was 46.5 points

Germany Flash Manufacturing PI for November

- November flash manufacturing PMI 42.3 vs 41.2 expected

- Prior 40.8

- Services PMI 48.7 vs 48.5 expected

- Prior 48.2

- Composite PMI 47.1 vs 46.5 expected

- Prior 45.9

The euro is nudging higher as the German economy shows signs of improving prospects in November. The manufacturing recession is not worsening much more and there are recovery signals, which is much welcome for the ECB too. Overall, the economy is seen contracting at a slower pace this month, putting off any heavy recession calls. HCOB notes that:

“Christmas is nearing and so is some hope for the German economy. Despite remaining in recession territory, the rate of slowdown has eased noticeably. Particularly heartening is the robust increase across nearly all subindices. This collective upswing fuels our growing confidence that a return to growth territory is a plausible prospect, potentially materialising by the first half of the upcoming year.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account