Booking Profit in USD/JPY As Sellers Resume Control

The Japanese Yen (JPY) fell after the announcement of weaker-than-expected core consumer inflation data, however, rising prospects of a Bank

The Japanese Yen (JPY) fell after the announcement of weaker-than-expected core consumer inflation data, however, rising prospects of a Bank of Japan (BoJ) policy move gave some support. The USD has played a big role as well, which has turned weaker in recent week, after the US cpi consumer inflation showed another slowdown, bigger than expected, which has killed any hopes for further FED rate hikes, turning this forex pair bearish.

For the 19th month in a row, inflation in Japan, both headline and core, has continuously exceeded the Bank of Japan’s 2% objective. Market forecasts currently point to the Bank of Japan exiting its negative interest rate policy early in 2024, fueled by the expectation of another substantial wave of pay rises next year, which will underpin ongoing inflation. Last night we saw the PPI price inflation move higher, as shown below, although both the PI and CPI have remained at normal levels in Japan. However, this is not consumer inflation but rather business-level inflation.

October PPI Producer Inflation from Japan

- PPI inflation for October +2.3% vs +2.1% expected

- September PPI inflation was +2.0%

- Measures the average change over time in the prices received by service providers (in the private sector) for their services in Japan

- Data published by the Bank of Japan

- Covers services such as transportation and communication, finance and insurance, wholesale and retail trade, and others

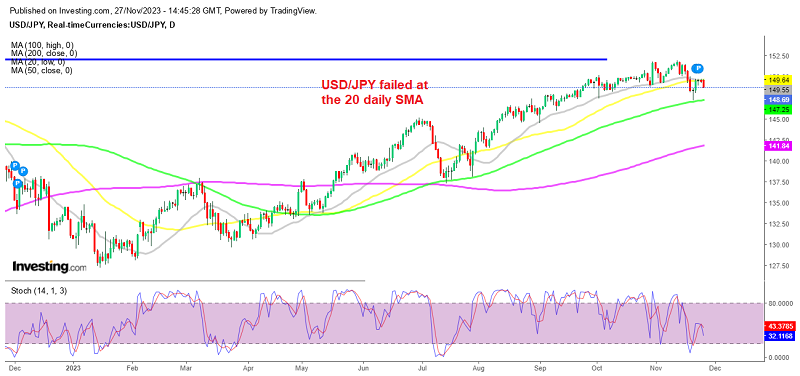

USD/JPY made a sharp reversal from the cycle high of 151.92 about two weeks ago, following weaker-than-expected US economic figures last week, which pulled Treasury rates and the US Dollar lower. Last week, the pair recovered and approached the important 150.00 zone, but buyers were showing weakness below this major level, with moving averages acting as resistance on the daily chart. We decided to open a sell USD/JPY signal last night after the Asian session opened and the price has reversed down again. Now the bias is more skewed to the downside as moving averages have turned from support into resistance, and purchasers may wait for the price to come into the trendline around the 146.00 handle, where they will have a much better risk-reward setup.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account