Not Expecting Much From Lagarde Today, As ECB Seems Happy With Slowing Inflation

EUR/USD remained bullish last week, although we saw a retreat lower during the first half, sending this pair to 1.0850s. However, it reverse

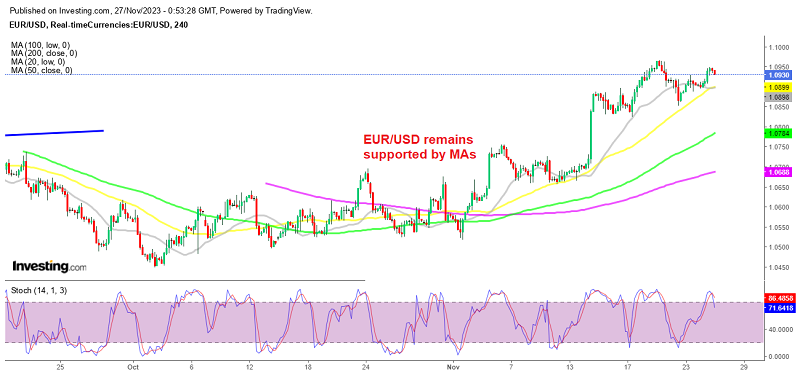

EUR/USD remained bullish last week, although we saw a retreat lower during the first half, sending this pair to 1.0850s. However, it reversed during the week as the USD weakness picked up again and closed above the 1.0900 level. There were a few events for the Euro last week which also helped, but the main driver at the moment is the decline in the USD.

The unexpectedly good Eurozone PMI statistics helped the risk sentiment somewhat. On Thursday the Eurozone Manufacturing PMI numbers showed an increase to 43.8 points in November, up from 43.1 points in October and marking a six-month high. While the Services PMI increased to 48.2 points in November from 47.8 points in October,

Later that day, the European Central Bank published the minutes of its October meeting, and there were some hawkish notes sprinkled throughout although without much effect on EUR/USD . The language tends to indicate that the central bank wants to keep markets guessing about rate hikes, but if things continue as they are, the tightening cycle will be complete, and some of the ECB members reinforced this. Later on today, the European Central Bank Christine Lagarde will testify before the Committee on Economic and Monetary Affairs of the European Parliament, in Brussels, but they have already made their point.

ECB’s Muller’s Comments Late Friday in Europe

- Inflation is clearly showing a trend of slowing

- We probably do not need to increase rates anymore.

- High ECB rates are smaller problem than high inflation.

Germany’s Bundesbank President (and European Central Bank Governing Council member) Nage

- The Bank’s rate hikes were impacting on the economy, slowing inflation

- But that inflation is not yet back down to a level where the ECB wants it

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account