Softer RBNZ Rhetoric Unable to Change the Trend in NZD/USD

The NZD has been on a long-term bearish trend although recently we have been seeing some bullish momentum which has sent the price above...

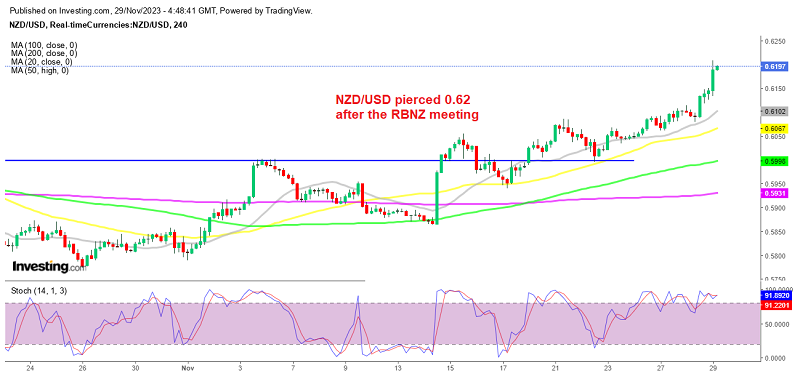

The NZD has been on a long-term bearish trend although recently we have been seeing some bullish momentum which has sent the price above moving averages on the daily chart and now buyers are in total control. It was sending out some encouraging signals last month, indicating that NZD buyers planned to take leadership, and this month they took the price over 0.60, establishing a strong bullish trend as the treasury yields and the USD retreats.

For more than three months, the NZD has been declining against the US dollar, with NZD/USD sliding below 0.58 in late October. The Chinese economic concerns we saw earlier this year as the country reopened after three years of coronavirus lockdowns dragged on risk assets, while the hawkish stance by the FED until recent weeks added to the bearish sentiment in risk sentiment and commodity dollar. But the sentiment has now recovered after the truce in Gaza, while markets expect no more hikes by the FED, which is weighing on US Treasury yields and the USD too.

The situation in New Zealand is similar, with the RBNZ holding its official cash rate steady at 5.50% in today’s meeting, which is the fifth time they have done so, therefore no one expects any more hikes from them either. Besides that, recent inflation statistics from New Zealand fell short of forecasts, supporting the RBNZ’s stance, so the NZD has nothing going on from its side/ All the bullish momentum in this pair is coming from the USD side.

On the daily chart above, we can see that this forex pair met the 100 SMA (green) at 0.60 while striking a major resistance zone near the 0.61 mark, which also happens to be where the 200 SMA (purple) was standing. Although both these levels were broken without much resistance and now the 0.61 level is where we can expect buyers to enter with a defined risk below the resistance in order to prepare for another push higher. The Reserve Bank of New Zealand kept its cash rate at 5.50% again today as predicted, but warned it will stay restrictive as long as inflation remains too high, which gave the MNZD another push higher.

Reserve Bank of New Zealand Policy Meeting

- Sees official cash rate at 5.63% in March 2024 (prior 5.58%)

- Sees official cash rate at 5.66% in December 2024 ( prior 5.5%)

- Sees official cash rate at 5.56% in March 2025 ( prior 5.36%)

- Sees official cash rate at 3.55% in December 2026

- Sees NZD TWI at around 70.7% in December 2024 ( prior 71.0%)

- Sees annual CPI 2.5% by December 2024 ( prior 2.4%)

- Interest rates are restricting spending in the economy and consumer price inflation is declining, as is necessary to meet the committee’s remit.

- Interest rates will need to remain at a restricted level for a sustained period of time

- However, inflation remains too high, and the committee remains wary of ongoing inflationary pressures

- Demand growth has eased, but by less than anticipated over the first half of 2023 in part due to strong population growth

- The committee is confident that the current level of the OCR is restricting demand

- The OCR will need to stay restrictive, so demand growth remains subdued, and inflation returns to the 1 to 3 percent target range

- If inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further

The Minutes of the RBNZ Meeting:

- Committee agreed that interest rates will need to remain at a restrictive level for longer

- Members agreed they remain confident that monetary policy is restricting demand

- Ongoing excess demand and inflationary pressures were of concern, given high core inflation

- Members discussed the possibility of the need for increases to the OCR

- Members agreed that with interest rates already restrictive, it was appropriate to wait for further data and information

- Members agreed that monetary policy was supportive of sustainable house prices

- Pressure in the labour market is easing, although employment remains above its maximum sustainable level

- Members also noted that most major central banks have indicated that they intend to retain current restrictive policy rates for longer, and are willing to tighten further, if required

- While growth in parts of the economy is slowing, there has been less of a decline in aggregate demand growth than expected earlier in the year

- The Committee noted that the estimate of the long-run nominal neutral OCR has increased by 25 basis points to 2.50%

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account