USD Tries to Make A Comeback After the PCE Inflation Report

The USD has been declining for several weeks, as markets shifted to expecting rate cuts soon next year by the FED, as inflation slows. EUR/U

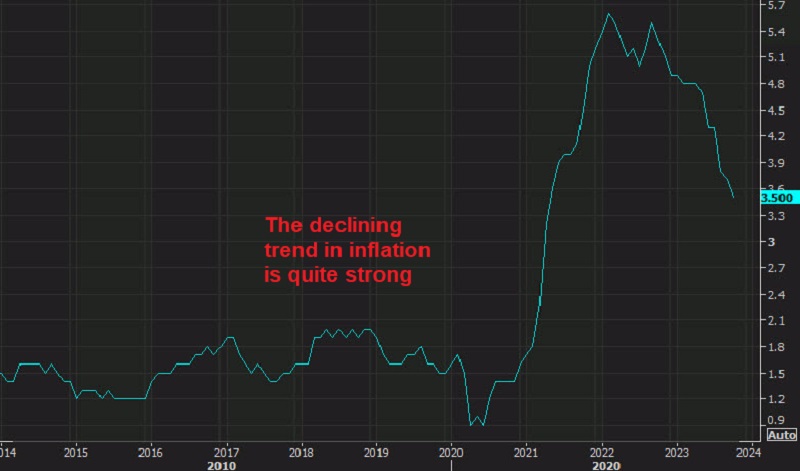

The USD has been declining for several weeks, as markets shifted to expecting rate cuts soon next year by the FED, as inflation slows. EUR/USD pushed above 1.10 earlier this week, as a result. But, today we are seeing a reversal in this pair which is threatening 1.09 now, as the USD buyers are putting up a fight following the PCE price index inflation figures from the US which were released just a while ago. Core PCE is headed in the right direction

Core PCE is headed in the right direction

Earlier we had the CPI (consumer price index) inflation report from the Eurozone, which showed another slowdown, helping in the EUR/USD reversal lower as well. The North American session has begun. So, the USD is the strongest of the major currencies today, while the EUR is the most vulnerable. Eurostat’s latest Eurozone inflation report, released this morning, showed that the preliminary Consumer Price Index (CPI) for November came in lower than expected in the Eurozone.

So, sellers are in control right now, although there is some strong support at 1.09 area, so let’s see if buyers will come back at this level. The US PCE inflation report is listed below:

September PCE Price Index Inflation

- US September PCE core +3.5% vs +3.5% expected

- August September PCE core was +3.7%

- PCE core MoM +0.2% vs +0.2% expected

- Prior core PCE MoM was +0.3%

- Headline PCE YoY +3.0% vs +3.0% expected (prior +3.4%)

- Deflator MoM +0.0% vs +0.1% expected (prior +0.4%)

Consumer spending and income for October:

- Personal income +0.2% vs +0.2% expected. Prior month +0.3%

- Personal spending +0.2% vs +0.2% expected. Prior month +0.7%

- Real personal spending +0.2% vs +0.4% prior

There are no major surprises here, but it is evident that inflation and core inflation are on the rise. Indications from November have also been encouraging, and the market has largely moved past concerns over inflation. Following this news and early jobless claims, the US currency has strengthened slightly.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account