US Employment Showing Dents Again Despite Stable Unemployment Claims

Yesterday the USD started the day soft but picked up some strength after some positive economic data from the US, such as the unemployment..

Yesterday the USD started the day soft but picked up some strength after some positive economic data from the US, such as the unemployment claims which showed stability in this sector. This sector has been a major contributor to keeping the US economy afloat, while other developed economies are close or in a recession. But, we have seen some weaknesses in the labour market recently, with JOLTS job openings falling below 9 million, while unemployment claims jumped higher earlier this month.

Yesterday’s unemployment and earnings/spending report also showed some caveats in certain components of the labour market. Consumer spending has slowed after a rapid increase in the Q3, reflecting the impact of increasing borrowing costs due to high interest rates and exhausted spare reserves among low-income households. While wages remain high, the rate of increase has slowed as labor market momentum has waned.

Personal income increased by 0.2% in October, following a 0.4% increase in the previous month. The increase in wages slowed to 0.1% after increasing 0.5% in September. Softer income growth, along with the commencement of student loan repayments for millions of US citizens last month, is expected to constrain spending next year. Nonetheless, the USD pushed hgiher yesterday, as Treasury yields reversed up, which sent commodity dollars lower, EUR/USD below 1.09, and XAU to $2,030 lows. But, let’s see if the USD can keep yesterday bullish momentum going.

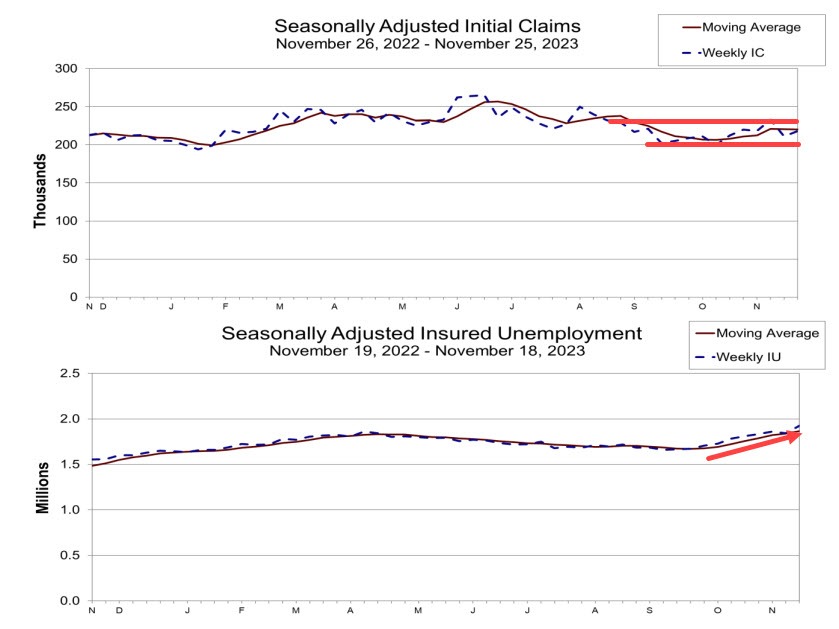

The US Initial Jobless Claims and Continuing Claims for the Current Week

Initial jobless claims and continuing claims

- Initial jobs claims prior week 209K revised to 211K

- initial jobs claims vs 220K estimate.

- 4-week moving average of initial jobs claims to 220K vs 220.50 last week .

- Continuing claims 1.927M versus 1.872M estimate. That is the highest November 2021

- Prior week of continuing claims 1.840M revised to 1841M

- 4-week moving average of continuing claims 1.866M vs 1.837M last week. That is the highest level since December 11, 2021.

The jump in continuing claims increased to the highest level in two years. Earlier in the year, initial unemployment claims were steady, but continuing claims were declining, indicating that people were getting jobs after being laid off. Now, ongoing claims are rising, implying that laid-off workers are not finding work. As a result, job markets are becoming softer.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account