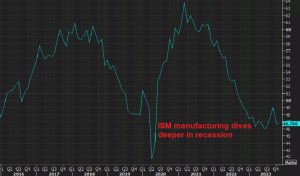

US Manufacturing Activity Fails to Move in Expansion

Today markets have been sluggish overall as they ease into December trade ahead of Fed Chair Powell's commentary. Markets are taking it easy

Today markets have been sluggish overall as they ease into December trade ahead of Fed Chair Powell’s commentary. Markets are taking it easy to start the new month, while Jerome Powell is not giving anything to markets to run. The manufacturing numbers on the other hand, remained unchanged as this sector remains in recession.

Powell is sounding more balanced, unlike the hawkish comments we heard from other FED members yesterday. The USD was mainly unchanged after some wobbling up and down, but it is now starting to decline after markets were expecting some hawkish remarks from Powell.

Earlier in the US session, we had the ISM manufacturing report, which came below expectations. On the surface, today’s miss in the US ISM manufacturing survey was minor. It was 46.7 points as opposed to an increase to 47.6 points. However, due to an unusually strong regional print yesterday, perhaps the consensus was not so accurate for what the market was expecting. People were talking about a 50 point reading after that, thus part of the subsequent selling in the US dollar could have been related.

We also heard from Chicago Fed President Goolsbee, who stated that inflation is falling ‘just’ as we want it to and that the labor market has improved. Those are clues of a dovish, or at least neutral, shift. Powell is the main event at the top of the hour.

ISM manufacturing PMI for November 2023 highlights

- November ISM manufacturing PMI 46.7 points vs 47.6 expected

- October ISM manufacturing PMI was 46.7 points

- Prices paid 49.9 points vs 45.1 prior

- Employment 45.8 points vs 46.8 prior

- New orders 48.3 points vs 45.5 prior

- Inventories 44.8 points vs 43.3 prior

- Production 48.5 points vs 50.4 prior

Comments in the report from respondents:

- “Economy appears to be slowing dramatically. Customer orders are pushing out, and all efforts are being made to right-size inventory levels, both to mitigate carrying costs on pushed-out orders and to load up on inventory where costs are exploding, like cold-rolled steel.” [Computer & Electronic Products]

- “Starting to feel softening in the economy, with labor still a challenge to backfill critical roles. The 2024 forecast looks challenging, specially from a cost perspective.” [Chemical Products]

- “Nearly all microchip supply issues have been resolved, finally bringing an end to the three-year chip shortage. Material prices are remaining relatively flat. Supply chain issues continue in several areas, resulting from difficulties during the United Auto Workers (UAW) strike.” [Transportation Equipment]

- “Our executives have requested that we bring down inventory levels considerably, and it has started causing customer shortages. Both finished goods, and low inventories of raw and packing materials are creating issues in fulfilling customer demand, and in some cases causing serious (production) delays.” [Food, Beverage & Tobacco Products]

- “The end of the major construction season and an early pullback in customer capital expenditures purchases have resulted in a lower backlog in the fourth quarter.” [Machinery]

- “Automotive sales still impacted by UAW strike. Still waiting for orders to come in, and we also need to work down inventory levels that increased during the strike period. This will most likely happen in December.” [Fabricated Metal Products]

- “Customer orders have pushed into the first quarter of 2024, resulting in inflated end-of-year inventory.” [Miscellaneous Manufacturing]

- “(Our situation is) good but guarded, as next year is hard to predict. There are undertones of uncertainty in the market and the impact of inflation on maintenance and project costs has become apparent.” [Nonmetallic Mineral Products]

- “Customers back online after the UAW strike. Consuming inventory that was built as a strike bank. Still (having) issues with hiring quality candidates for both hourly and salaried positions. Current inventory levels are too high, but the order book remains strong.” [Primary Metals]

- “Elevated financing costs have dampened demand for residential investment. Our business has been negatively impacted through reduced new orders for our products and services. We are purchasing less for production and finished goods inventories.” [Wood Products]

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account