EUR/USD Testing 1.08 In What Seems a Trend Reversal

The economic data from the US was showing weakness early in the year, but in summer we saw some improvement, while Europe...

The economic data from the US was showing weakness early in the year, but in summer we saw some improvement, while Europe and other developed economies were showing increasing weakness as they headed for recession. That kept the USD bullish until early October, followed by a month of consolidation. By the end of that month, the USD started turning bearish as the economic data started deteriorating, and now we’re getting some more weak figures from the US.

Today the main indices from European markets took a pause, while the US counterparts are enduring some losses. The NASDAQ index, which is down roughly 1%, is leading the falls. Each of the major indices advanced last week, extending the uptrend to 5 weeks. Is it time for a catch-up week? US rates are rising, with the 10-year yield already up more than 4 basis points. The two-year yield has risen by 6 basis points.

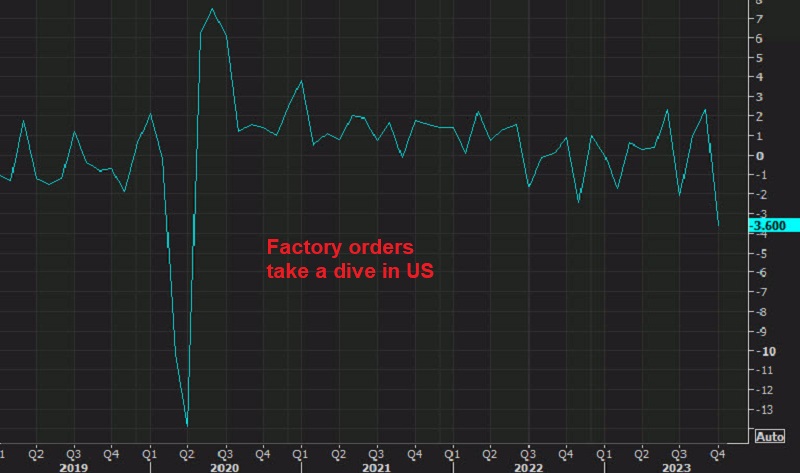

US factory orders for October 2023

- October factory orders -3.6% vs -2.8% expected

- Lowest reading since April 2020

- September factory orders was +2.8% (revised to +2.3%)

Details:

- Factory orders ex-transportation for October -1.2% versus +0.8% last month (revised to +0.4%)

- Durable goods order revised -5.4% versus -5.4% preliminary and +4.0% prior month

- Durable goods ex-defense -6.7% versus -6.7% preliminary. Last month +5.0%

- Nondefense capital ex-air -0.3% versus -0.1% preliminary. Last month -0.2%

- Durable goods ex transportation 0.0% vs 0.0% preliminary. Last +0.2%

Large one-time orders can skew these data, and in this case, the auto strike was a significant drag, so we’ll likely see a recovery for the coming months. Ford reported overall sales of 145,559 vehicles in November, a 0.5% decrease from 146,364 units the previous year. The strike may have had an effect, but auto lots had adequate inventory.

Automobiles, in my opinion, will be one of the more interesting markets in the coming year. I believe it will suffer since stocks have been rebuilt, long-lead sales are drying up, and financing rates are high, but this has me reconsidering automakers’ ability to compete.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account