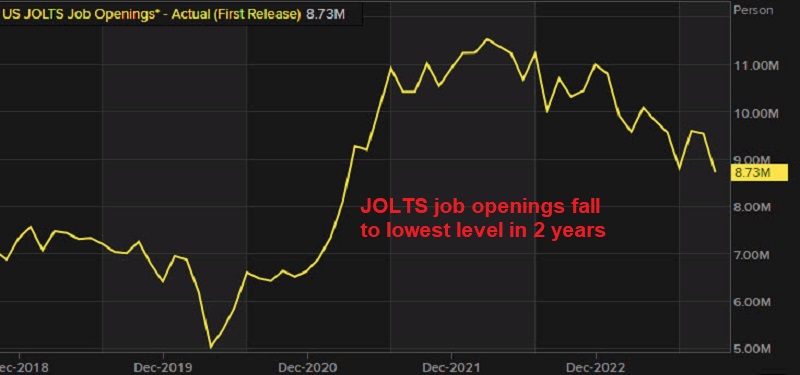

US Employment Weakens as JOLTS Jobs Fall, Yet the USD Continues to Pushe Higher

Employment surged in the US after coronavirus restrictions which has been helping the US stay afloat in the last two years, but now it seems

Employment surged in the US after coronavirus restrictions which has been helping the US stay afloat in the last two years, but now it seems like the surge might have ended. New job opportunities in the United States have reached their lowest level since March 2021 according to the JOLTS report. nonetheless, the USD is continuing yesterday’s advance against all currencies apart from the Yen.

The Fed will be more confident in stopping the rate-hiking cycle and transitioning to rate reduction in 2024 as a result of this decline. Job opportunities in the JOLTS survey declined to 8.733 million from 9.553 million, falling far short of the consensus of 9.3 million. The FX market reacted quickly, with the US dollar falling. However, it has risen since the publication, thanks in part to a slightly better ISM services index released at the same time.

JOLTs Job Openings October 2023

- JOLTs October job openings 8.733M vs 9.300M estimate

- Lowest level since March 2021.

- Prior month 9.553M (revised to 9.350M)

- Hires 3.7% vs 3.7% prior.

- Separations rate 3.6% vs 3.6% prior.

- Quits 2.3% vs. 2.3% prior. It was the 4th consecutive month at the same rate

Job Openings: In October, on its final business day, there was a notable decrease in job openings, dropping by 617,000 to 8.7 million. This decline was reflected in the job openings rate, which fell to 5.3%, a decrease of 0.3 percentage points from the previous month and 1.1 points from the previous year. Significant reductions in job openings were observed in several sectors: health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). Conversely, the information sector experienced an increase in job openings, adding 39,000 positions. Lower job openings are an indication of a weaker jobs picture.

Quits: In October, the number of quitters changed little at 3,600,000 and the rate was 2.3% for the 4th consecutive month. The number of quotes increased in professional business services (+97k). When quits increases it is a sign of confidence in the job market. With the number staying little change for the 4th consecutive month, the confidence is waning a bit.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account