EUR/USD Struggles Below 1.0800 Amid Mixed Eurozone Data

The Euro to U.S. Dollar (EUR/USD) exchange rate remains subdued below the key 1.0800 mark in early Asian trading on Wednesday.

The Euro to U.S. Dollar ( EUR/USD ) exchange rate remains subdued below the key 1.0800 mark in early Asian trading on Wednesday. Despite some positive Eurozone PMI statistics for November, the Euro struggles to find demand due to the continued economic softness within the bloc. Currently, the pair is marginally up, trading near 1.0795.

Eurozone’s economic activity contracted in November, with the HCOB Eurozone Composite PMI lingering below the expansionary benchmark, indicating a sustained downturn in private sector output.

lthough the November Composite PMI ticked up to 47.6, surpassing expectations and the previous month’s 47.1, it was not enough to bolster the Euro, especially as key economies like France, Germany, and Italy reported a slump in business activities.

Conversely, the U.S. Dollar finds some resiliency around the 104.00 mark, seemingly unaffected by the dip in Treasury yields. Contributing to the Dollar’s firmness was the ISM Services PMI, which outperformed forecasts by notching up to 52.7 for November. However, the JOLTS Job Openings unexpectedly dropped to a 20-month low, suggesting a cooling labor market.

Investors are now turning their attention to the forthcoming Eurozone Retail Sales data, anticipating a 1.1% year-on-year decrease but a 0.2% monthly increase for October. Stateside, the market is awaiting the U.S. ADP employment report and Unit Labor Costs, which could provide further direction.

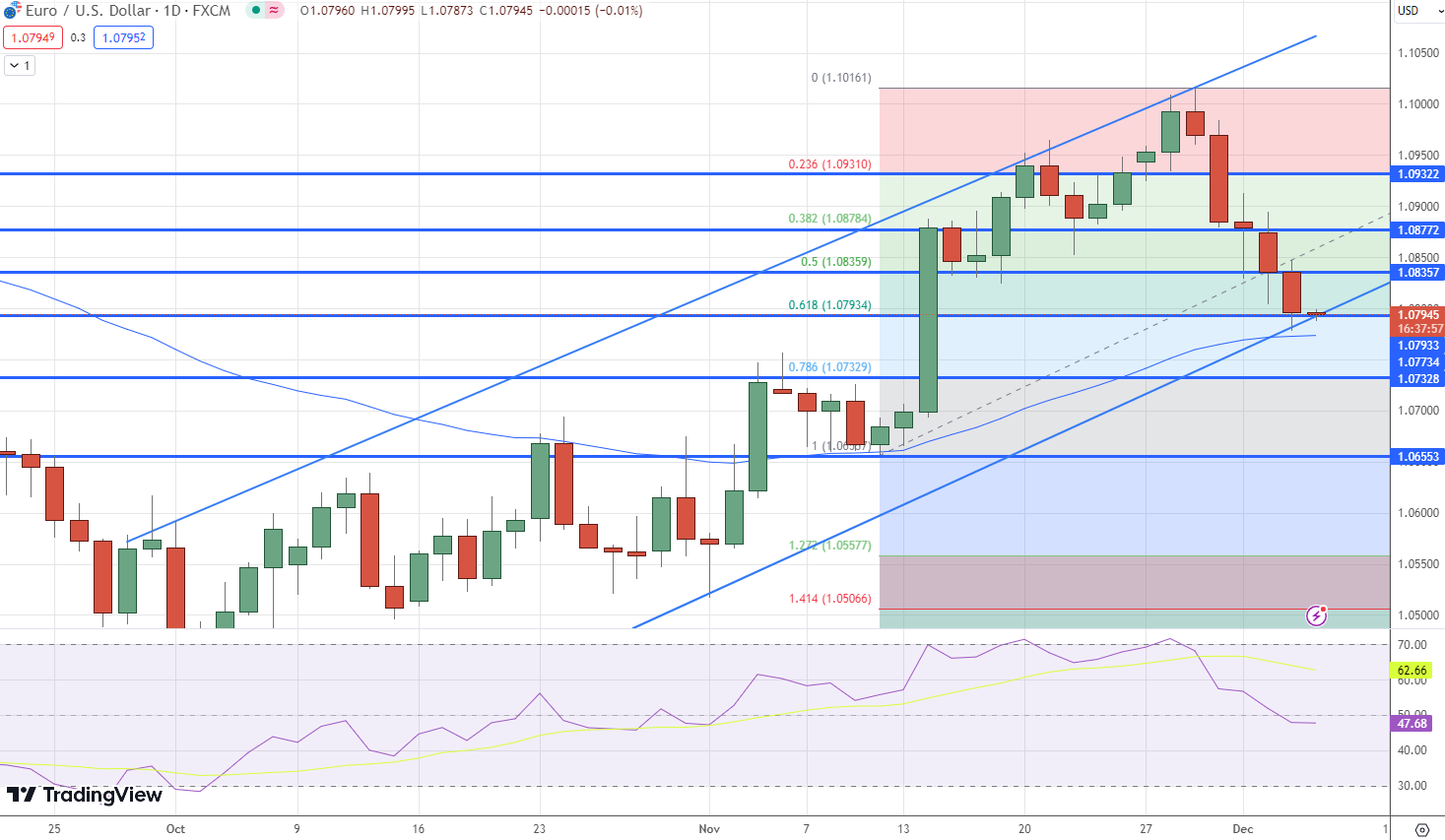

From a technical perspective, the EUR/USD pair hovers at a pivotal juncture around 1.0800, having neared the anticipated bearish target of 1.0760. While there’s potential for a bullish intraday reversal, resistance from the EMA50 suggests a wait-and-see approach is prudent for now.

From a technical perspective, the EUR/USD pair hovers at a pivotal juncture around 1.0800, having neared the anticipated bearish target of 1.0760. While there’s potential for a bullish intraday reversal, resistance from the EMA50 suggests a wait-and-see approach is prudent for now.

A decisive move above 1.0860 could initiate a recovery towards 1.0960, whereas a breach of the 1.0760 support might lead to extended losses towards 1.0645.

Today’s forecast remains neutral, with a trading range expected between 1.0710 support and 1.0880 resistance, pending clearer trend signals.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account