GBP/USD Fails at the 200 Weekly SMA, Construction PMI Improves

In November GBP/USD resumed the bullish momentum which started in Late September last year after the intervention by the Bank of England...

In November GBP/USD resumed the bullish momentum which started in Late September last year after the intervention by the Bank of England and pushed to 1.2730s. But, buyers failed to break above the 200 SMA on the weekly chart and the price has made a reversal lower, losing around 150 pips.

The reversal started on Monday and continued yesterday as well despite higher UK PMI statistics, showing that the activity in the service sector moved away from contraction. In the United Kingdom, inflation has moderated, but Bank of England Governor Andrew Bailey highlighted the difficulties in achieving the 2% CPI target.

He pointed out that the recent drop in the headline CPI (consumer price index) from 6.7% to 4.6% in October is mostly due to lower energy prices. Bailey emphasized the importance of containing inflation, emphasizing its potential negative impact on households, particularly as increasing prices exacerbate living conditions.

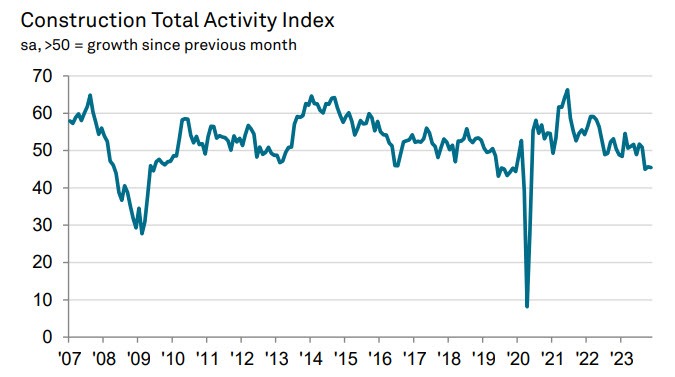

However, markets are not really expecting any more rate hikes by the BOE, which should be a reason to keep the GBP soft and GBP/USD bearish. Although there is the USD side in this equation as well. Earlier today we had the construction PMI report from the UK which has been in contraction in the last two months, but it was expected to show some improvement as well.

UK November Construction PMI Report![UKPMI]()

- November construction PMI 45.5 points vs 46.3 points expected

- October construction PMI 45.6 points

The UK contraction sector is contracting and today’s numbers indicate another dip in activity. House building affects the entire sector as new house building slumped again. Purchasing costs posted the biggest fall in 14 years as a result of declining raw materials and lower demand for building products but employment conditions declined for the first time this year indicating that labor market conditions have deteriorated.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account