Will Risk Assets Turn Bullish in 2025 as Global Services Activity Makes A Turnaround?

The global economy has been softening considerably in the last two years as inflation surged and central banks raised interest rates at an u

The global economy has been softening considerably in the last two years as inflation surged and central banks raised interest rates at an unprecedented pace, after the rebound following the removal of the coronavirus restrictions. Developed economies were heading into a recession and still are to some degree, but we are seeing some positive signals here and there.

Yesterday was a services day, which showed that this sector is moving away from contraction. The day started with the Chinese Caixin manufacturing which showed a jump to 51.1 points, followed by the UK services PMI, which also moved away from contraction, while Eurozone services activity remains in recession but it improved in November nonetheless.

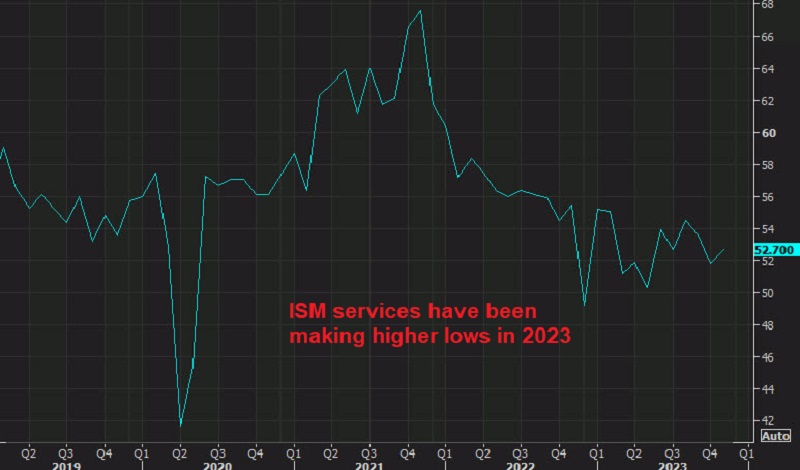

The day ended with the US ISM services which also showed improvement for the 11th month in a row. The ISM Services PMI came at 52.7 points, up from 51.8 points the previous month and beyond market estimates of 52.0 points. According to the publication’s additional details, the Business Activity Index reached 55.1 points this month, up from 54.1 earlier.

Besides that, the Employment Index increased from 50.2 to 50.7 points. In November, the Prices Index fell from 58.6 to 58.3 points. These are consistent figures that hint to a healthy economy. There is no recession in the data, but neither is there much growth, and I believe the market is comfortable with that. So, we’re seeing positive signs that should help stock markets and risk currencies such as commodity dollars later on during 2024, so that’s one thing to keep in mind when trading the AUD or NZD next year.

November 2023 US Services from the Institute for Supply Management

- November ISM services 52.7 points vs 52.0 points expected

- October ISM services PMI was 51.8 points

Details:

- Employment index 50.7 points versus 50.2 prior

- New orders index 55.5 points versus 55.5 prior

- Prices paid index 58.3 points versus 58.6 prior

- New export orders 53.6 points versus 48.8 prior

- Imports 53.7 points versus 60.0 prior

- Backlog of orders 49.1 points versus 50.9 prior

- Inventories 55.4 points versus 49.5 prior

- Supplier deliveries 49.6 points versus 47.5 prior

- Inventory sentiment 62.2 points versus 54.4 prior

Comments in the report from respondents:

- “Restaurant sales and traffic trends are consistent with the previous month and at our annual seasonal lows — should pick up again in December. We continue to trend positive to pre-pandemic and last year.” [Accommodation & Food Services]

- “Opportunities across the construction industry remain strong. The labor market for skilled trades workers is tight.” [Construction]

- “Supplies and merchandise are holding steady.” [Educational Services]

- “Business conditions remain steady to the end of 2023. Annual cost escalations are a bit higher than planned, more than 5 percent versus 3 percent due to overall economic conditions and concerns.” (Finance & Insurance)

- “Signs of recovery are on the horizon — (profit) margins remain tight, but revenue is improving and labor appears to be stabilizing. Supply chains are operating well, but a few major manufacturers continue to show signs of constraints that have persisted for some time. Capital investment remains constrained; however, optimism has returned for a turnaround in calendar year 2024.” [Health Care & Social Assistance]

- “There are fewer new projects in comparison to last month and November 2022. Customers are not requesting quotes for new services.” [Information]

- “Customers are conservative in spending, so competition to maintain market share is tight.” [Management of Companies & Support Services]

- “Fourth-quarter revenues lower than projected. Seeing negative revenues trend into the first quarter of the new year. We remain positive yet concerned about 2024.” [Professional, Scientific & Technical Services]

- “Prices for most items increasing, but only slightly. Increase in pricing for services much more noticeable and impactful on the organization.” [Public Administration]

- “Candidate expectations during the hiring process have made staffing up more difficult.” [Retail Trade]

- “Solid activity heading into the final stretch of the fourth quarter.” [Transportation & Warehousing]

- “Labor, equipment and material price escalation requests are increasing, both through existing contracts as well as re-pricing of markets via requests for proposal.” [Utilities]

- “A comparably flat month of business activity — no major swings one way or the other. Inventories in our extended supply chain look healthy, and fill rates are improving.” [Wholesale Trade]

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account