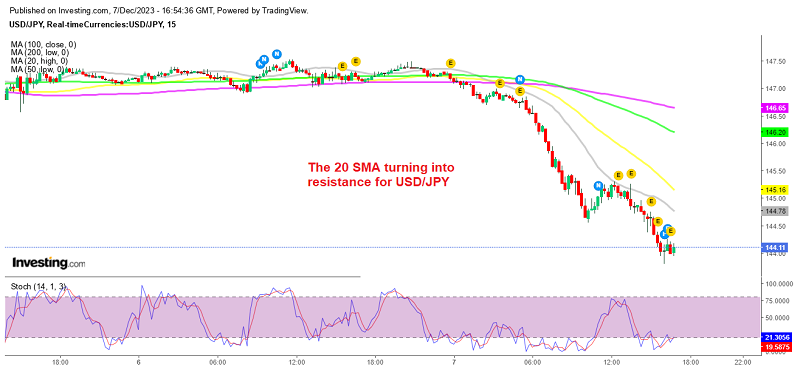

Remaining Short on USD/JPY After the 350 Pip Dive on Hawkish BOJ

Today the economic calendar has been light, with the US unemployment claims for last week, although, comments from the BOJ governor Ueda who

Today the economic calendar has been light, with the US unemployment claims for last week, although, comments from the BOJ governor Ueda who discussed a policy exit, sent the JPY surging higher which is also the strongest currency today. Although the USD is showing some weakness across the board once again.

USD/JPY was already weaker after falling around 300 pips in the Asian session, trading at 144.60. Then we saw a 100 pip bounce as Ueda met with Japan’s Prime Minister Kishida, who spoke about the importance of wages in their next policy actions, and this pair took another dive, falling below 144.

This suggests that the BOJ is now united with the Japanese government to begin tightening back on their ultra-easy policy settings in March or April of next year. The US unemployment claims report which was released earlier today didn’t have much impact on the USD, since we’re waiting for the non-farm payrolls report to be released tomorrow.

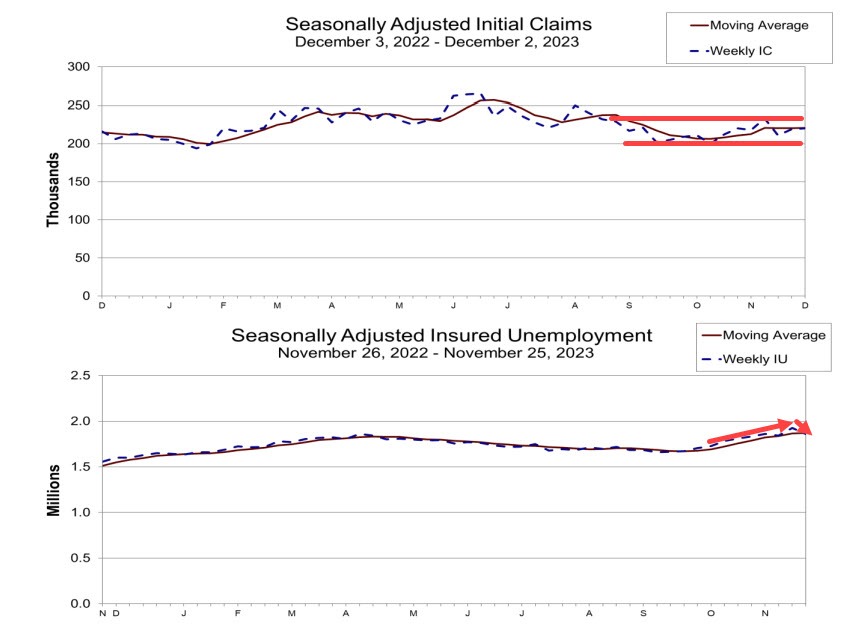

US Initial Unemployment Claims and Continuing Claims for the Week![Initial jobs claims]()

- Initial jobless claims 220K versus 222K estimate in the current week

- Prior week 219K versus 218K previously reported

- Initial jobless claims 220K versus 222K estimate

- 4-week moving average 220.75K vs 220.25K last week

- Continuing claims 1.861M versus 1.910M estimate

- Prior week 1.925M revised down from 1.927M last week

- 4-week moving average of continuing claims 1.872M versus 1.865M last week.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account