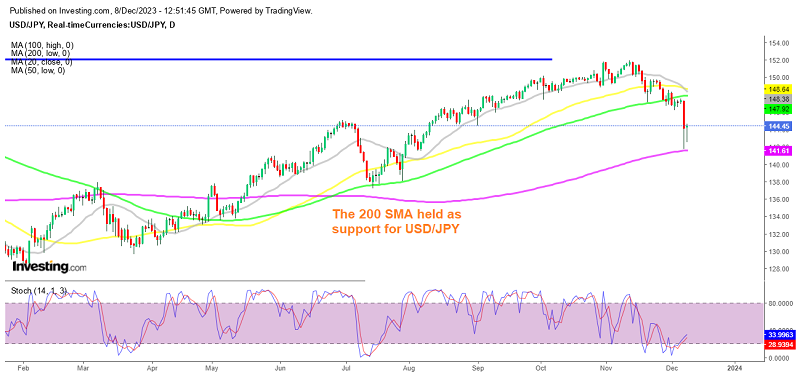

The USD/JPY Crash Stops at the 200 SMA

The bullish trend in USD/JPY has been very strong since early this year, sending this pair close to all-time highs at 152.

The bullish trend in USD/JPY has been very strong since early this year, sending this pair close to all-time highs at 152. But comments from BOJ governor Ueda yesterday about a policy exit led the JPY higher, which gained more than 600 pips by the end of the day. Although, the 200 daily SMA held as support and the price bounced off that moving average twice. Will we see a bounce higher in USD/JPY or a break lower?

Will we see a bounce higher in USD/JPY or a break lower?

With Japanese salaries projected to rise significantly next year as firms increase pay hikes to battle increasing prices, the Bank of Japan appears ready to begin contemplating reversing its long-running zero rate policy mechanism. BoJ Governor Kazuo Ueda made some unusually hawkish comments, hinting at the eventual end of the BoJ’s negative rate policy, perhaps in Q1 of 2023. The JPY surged higher as a result which caught many traders unprepared.

Money markets presently price in a 20% possibility of a BoJ rate hike during the Japanese central bank’s forthcoming policy meeting on December 18 and 19. The next quarterly growth and interest rate review by the Bank of Japan is scheduled for the end of January.

Looking at the other side of the coin, the US Core PCE came in line with expectations last week, as inflation continues to follow a slowing trend, while this week employment has also been showing signs of weakness, with JOLTS jobs falling to the lowest levels in two years. Fed Chair Powell reiterated that they are proceeding with caution since the full consequences of policy tightening have yet to be felt.

Moving averages were acting as support for this pair during the bullish trend, particularly the 20 SMA (gray) which shows that the bullish trend was quite strong. But USD/JPY broke below this moving average and after an initial bounce off the 100 SMA (green), it crashed lower in response to comments from Bank of Japan Governor Ueda. This could have generated some momentum-based algo reaction, so USD/JPY extended the decline once the important 145.00 handle was broken. The bias for the pair remains bearish, so we have been selling the retraces higher.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account