USD Dives and Resurfaces after the Inflation Report

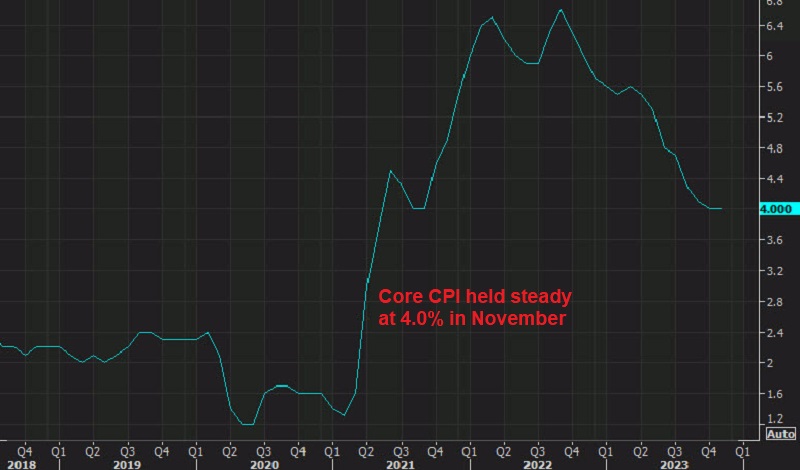

The November inflation report from the US came in line with expectations, with CPI ticking down to 3.1% and core CPI staying at 4.0%

The highlight today was the US CPI (Consumer Price Index) inflation report, which was released a while ago. The immediate market reaction after the numbers was to dump the USD, but it swiftly reversed its position and the USD is climbing up, particularly on the core CPI numbers which remained unchanged, showing that prices for consumer goods keep going up.

The algorithms got sort of confused as well, with the market pricing in 115 basis points of Fed reduction in 2024, which increased to 120 basis points right after the report was released, before falling back to 110 basis points now as the USD makes its way back up. Another reason for the reversal might be the market buying the USD ahead of the FOMC meeting tomorrow, with the idea that Jerome Powell may push back against aggressive cut pricing, particularly for the March meeting, with markets anticipating a 50% cut, which is a bit too much, but rates will likely go down the same way they went up.

US November 2023 Consumer Price Index Data

- November CPI YoY +3.1% versus 3.1% expected

- October CPI YoY was 3.2%

- November CPI MoM +0.1% versus 0.0% expected

- October CPI MoM was 0.0%

Core measures:

- November Core CPI mMoM +0.3% versus +0.3% expected. Last month 0.2%

- November Core CPI YoY 4.0% versus 4.0% expected. Last month was 4.0%

- Shelter +0.4% versus +0.3% last month. Up 6.5% y/y

- Services less rent of shelter +0.6% m/m vs +0.3% prior (+3.5% y/y)

- Core services ex housing +0.44% m/m

- Real weekly earnings +0.5% vs -0.1% prior

- Food +0.2% m/m vs +0.3% m/m prior

- Food +2.9% y/y

- Energy -2.3% m/m vs -2.5% m/m prior

- Energy -5.4% y/y

- Rents +0.5% m/m vs +0.5% prior

- Owner equivalent rent +0.5% vs +0.4% prior

- Full report

Later today a 30-year Treasury auction, although this seems to be mostly about pre-Fed positioning, since the uncertainty of the outcome is very high. As a result, we might see some irrational price action during this period until tomorrow evening.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account