US Economy Keeps Giving Positive Signs As Services Improve Again

Markets were uncertain of the FOMC outcome at the beginning of this week, but turned bearish on the USD after the FED and Powell confirmed..

Markets were uncertain of the FOMC outcome at the beginning of this week, but turned bearish on the USD after the FED and Powell confirmed rate cuts are to come soon. Although we have seen some decent economic numbers from the US this week, which have improved the sentiment for the USD somewhat, so we have seen some kind of pushback from buyers.

Yesterday retail sales for November came in positive, showing an increase last month, beating expectations of a decline, which indicates that the US consumer is in good shape. Earlier today the S&P Global Services PMI also came in above expecations once again, showing that the trend in this sector is improving. Gold retreated lower below $2,030 after testing $2,050 yesterday while USD/CHF is heading higher for 0.87. T

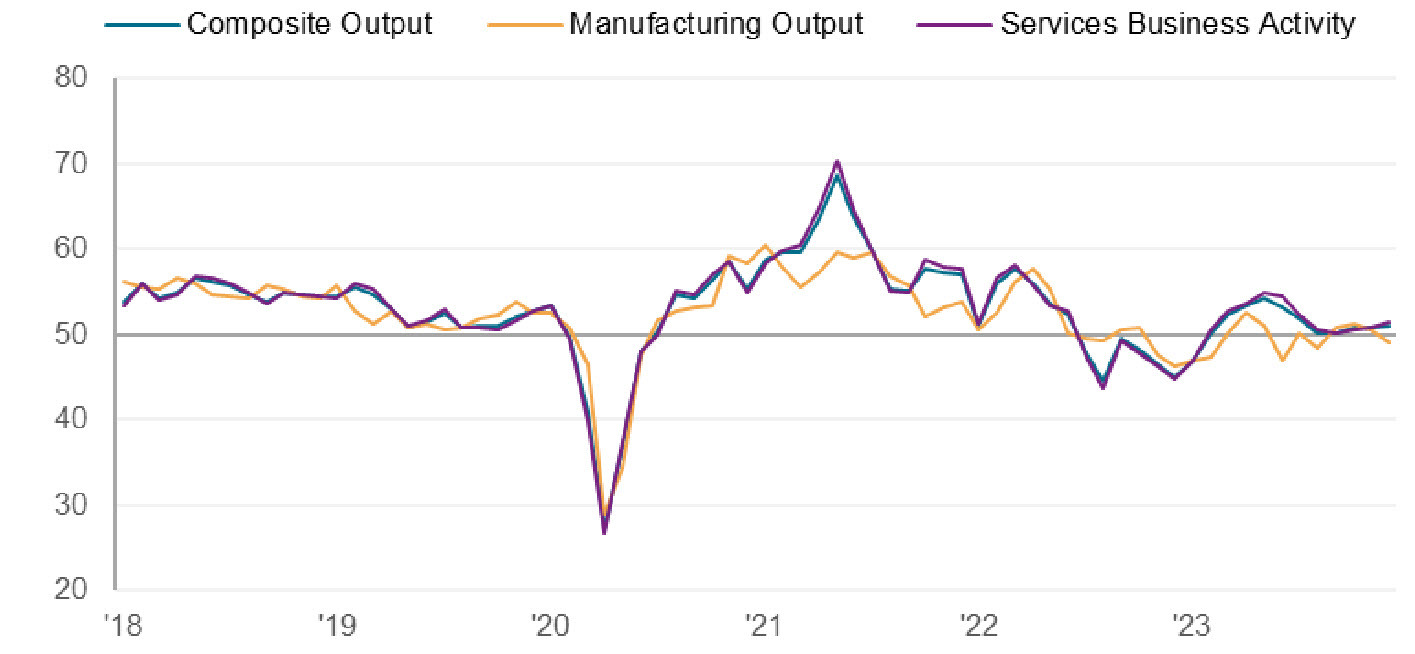

US November Services and Manufacturing PMIs from S&P Global

- November services PMI from S&P Global 51.3 points vs 50.6 expected

- October services PMI was 49.4 points

- Manufacturing 48.2 points vs 49.3 points expected (prior was 49.8 points)

- Composite index 51.0 points vs 50.7 points prior

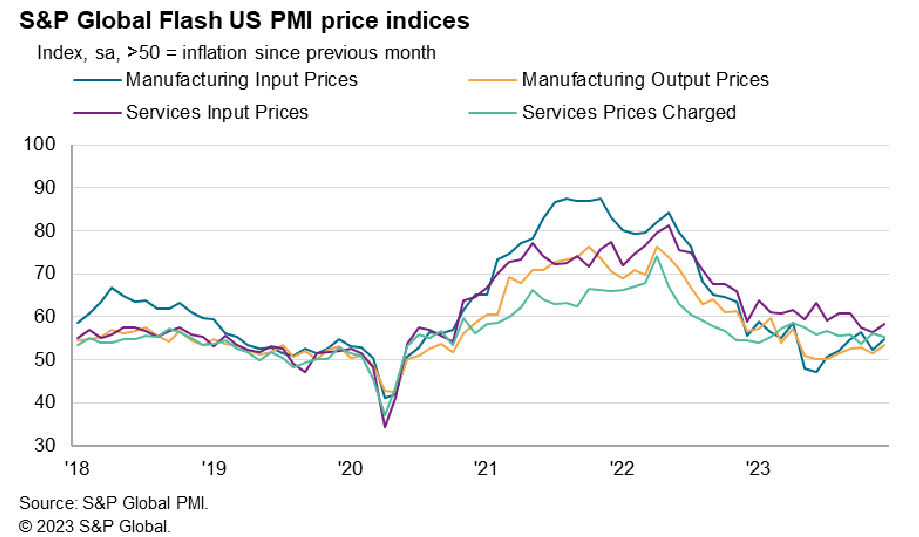

- Cost pressures gained momentum as input prices increased at the quickest pace since September

- Although firms continued to pass through higher costs to customers, and at a strong rate, the overall pace of prices charged inflation softened from November

- Employment improves, highest since September

The offerings The PMI rose to a five-month high due to an increase in new orders. The focus is on inflation, which has risen somewhat. That’s not progress, but it’s difficult to get enthused about a minor improvement.

Comments in the report from Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“The early PMI data indicate that the US economy picked up a little momentum in December, closing off the year with the fastest growth recorded since July.

“Looser financial conditions have helped boost demand, business activity and employment in the service sector, and have also helped lift future output expectations higher. However, the increased cost of living and cautious approach to spending by households and businesses means the overall rate of service sector growth remains far short of that witnessed during the travel and leisure revival back in the spring and summer.

“Manufacturing meanwhile remains a drag on the economy, with an increased rate of order book decline prompting factories to reduce production, cut back on headcounts and scale back their input buying.

“Despite the December upturn, the survey therefore signals only weak GDP growth in the fourth quarter.

“The survey’s selling price gauge, which tends to lead changes in consumer price inflation, remains sticky but at a level which is indicative of CPI running only modestly above 2%. Service sector input cost inflation, a key gauge of core inflation, once again remained notably elevated by historical standards, though even here the average rate of increase in the fourth quarter has been the lowest since mid-2020.”

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account