EUR/USD Trades Close to 1.10 As ECB Continues to Deny Rate Cuts

Today markets were mostly quiet during the European session but in the US session the USD has started slipping lower again, resuming yesterd

Today markets were mostly quiet during the European session but in the US session the USD has started slipping lower again, resuming yesterday’s price action, as us bond yields fall lower, with US 10-year bond yields below 4%. This is a new low since summer, highlighting the relentless bid for bonds as the FED prepares to cur interest rates. EUR/USD has risen to 1.0965 from a low of 1.0930 earlier in the day, as buyers try to keep the price close to 1.10, which is a bullish signal.

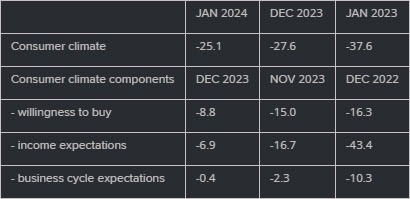

Earlier in the European session we had the inflation CPI report which came much softer than expected, which sent the GBP lower and is painting an increasing bearish for the GBP in the coming months. The German GfK consumer confidence report was also released this morning, showing an improvement and a positive revision for last month.

Germany December Consumer Sentiment Released by GfK – 20 December 2023

- December GfK consumer sentiment -25.1 points vs -27.0 points expected

- November GfK consumer sentiment was -27.8 points

German consumer morale appears to be improving to begin the new year, although it remains in a very terrible state overall. A rise in income expectations was a major contributor to the improved morale, but there was also an increase in consumer readiness to buy and optimistic economic forecasts. The specifics:

ECB Member Knot Rejecting the Rate hike Idea

- Rate Cut Unlikelihood in H1 2024:

- A rate cut in the first half of 2024 is considered unlikely based on current information.

- Monitoring Wages Data:

- The speaker emphasizes the importance of monitoring wages data and mentions that data around the middle of 2024 will be crucial. Wage data is a significant factor for central banks in assessing inflation and overall economic conditions.

- Optimal Rate Path and Market Pricing:

- The optimal path for interest rates is suggested to be closer to market pricing at the cut-off date than at the current moment. This implies that the speaker believes the central bank’s rate decisions should align more closely with market expectations.

- Structural Bond Portfolio Size:

- The statement suggests that any structural bond portfolio should be as small as possible. This could reflect a view on the optimal size of bond holdings in a portfolio, possibly considering factors like risk and market conditions.

The odds of a rate cut in March by the ECB are 50/50 right now, with a 100 basis point cut factored in by July. Finally, the market believes that the ECB will decide that it can soften a little without being too loose, and that the Eurozone economy will deteriorate further.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account