Markets Anticipate BOE Rate Cuts As UK Inflation Falls Below 4%

After retreating 11 cents lower from July until October, GBP/USD made a bullish reversal in November and has been pushing higher, despite th

After retreating 11 cents lower from July until October, GBP/USD made a bullish reversal in November and has been pushing higher, despite the occasional pullback lower. Moving averages have turned into support, which is a strong bullish sign, with the FED signaling a policy shift and the beginning of rate cuts early next year.

So, while the FED has turned dovish, the BOE is trying to sound hawkish by keeping rate hike options open. Buyers are in control and GBP/USD has been rallying higher, breaking above last month’s high, as it heads for 1.30. Comments from Bank of England (BoE) chairman on the need for patience in relaxing the monetary policy, while waiting to see a continuous reduction in wage inflation, have been keeping the GBP bullish.

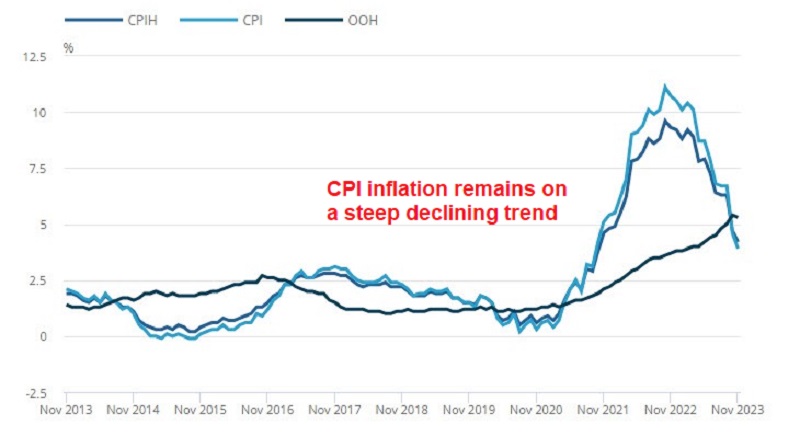

Fundamentals don’t really support this outlook for the GBP, with the economy heading for recession and inflation falling. Earlier today we saw the November CPI (Consumer Price Index) inflation report, which was expected to show a decline to 4.3% YoY, from 4.6% in October.

UK November Consumer Price Index Inflation Report

- November CPI YoY +3.9% vs +4.4% expected

- October CPI was +4.6%

- Core CPI YoY +5.1% vs +5.6% expected

- Prior coe CPI YoY was +5.7%

Despite the BOE’s protests, a clear miss on inflation statistics like this one will continue to demonstrate to markets that they are correct to price in faster rate reduction. As a result, the pound has plummeted, with speculators expecting the BOE to decrease interest rates for the first time in May. Before the report, the odds were 65%, so we’ll see how they change at the open later.

Returning to the report, the specifics show that food price inflation has also slowed, with the annual figure now falling below double digits to 9.2% in November. With core prices also falling faster than projected, the BOE may be forced to change their stance sooner rather than later, given market pressure. However, I believe that 5% is still too high a bar for the time being.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account