USD Resumes Decline After Slightly Softer GDP Revision

The last revisions for the US Q3 GDP report was released a while ago and the US currency resumed the decline, with equities futures resuming

•

Last updated: Thursday, December 21, 2023

The last revisions for the US Q3 GDP report were released a while ago and the US currency resumed the decline, with equities futures resuming the upside momentum. This price action seems a bit strange as the data wasn’t exactly dovish, but it seems like the market just wants to sell the USD right now.

Initial jobless claims were lower, which boosted the USD. The Philly Fed was dovish, and GDP had some dovish details, but it’s a stale report at this point. Perhaps the market was focused on the core PCE Q3 figure falling to 2.0% from 2.3%, underlining how close the Fed is to its aim.

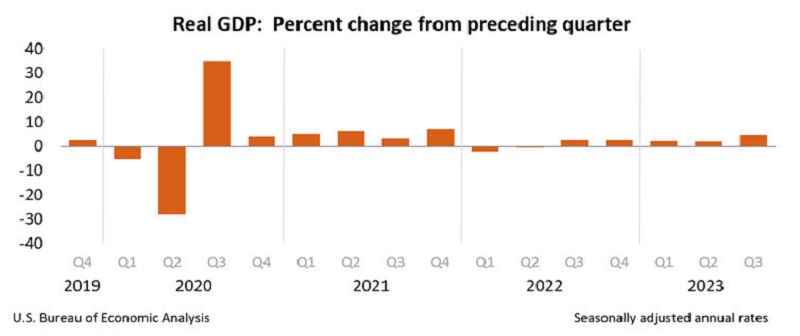

US Q3 2023 Final GDP Reading

- Q3 2023 GDP YoY (third reading) +4.9% vs +5.2% expected

- The Q2 final reading was +2.1%

Details:

- Consumer spending +3.1% vs +3.6% prelim

- Consumer spending on durables +6.7% vs -0.3% prior

- GDP final sales +3.6% vs +3.7% prelim

- GDP deflator +3.3% vs +3.5% prelim

- Core PCE +2.0% vs +2.3% prelim

- Corporate profits +3.7% vs +4.1% prelim

- Business investment +5.2% vs +3.9% prelim

Percentage point changes:

Net trade +0.03 pp vs -0.04 pp prelim

Inventories +1.27 pp vs +1.40 pp prelim

Govt +0.99 pp vs +0.94 pp prelim

Gold XAU Live Chart

GOLD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.