US Employment Sector Remains Stable but That’s Not Helping the USD Any Longer

The USD was holding on last month and was rallying higher after strong employment numbers, with the idea that the FED would hold interest...

The USD was holding on last month and was rallying higher after strong employment numbers, with the idea that the FED would hold interest rates higher for longer. But, in the last meeting, the FED and Jerome Powell made it clear that rate cuts are coming, so the employment numbers are not helping the USD anymore.

Yesterday’s US unemployment claims report leaned on the positive side, but the USD slipped lower nonetheless. This shows that the Buck is in the middle of a bearish phase and we will try to sell it against other major currencies, which are not in a good position either, but last week’s FOMC meeting has put the USD in a worse position.

The US Initial and Continuing Jobless Claims Report

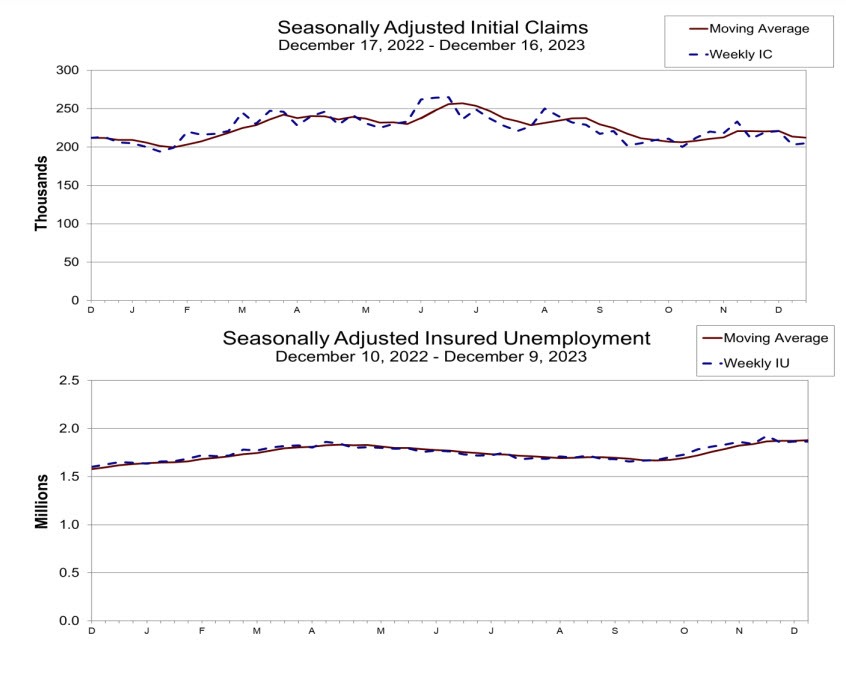

Initial claims and continuing claims charts

- Initial jobless claims 205K vs 215K estimate

- Prior week 202K (were estimating 220K) revised to 203K

- 4-week MA jobless claims 212K vs 213.50K

- Continuing Claims 1.865M vs 1.888M estimate. Prior week 1.876M revised to 1.866M

- 4-week MA continuing claims 1.878M vs 1.872M last week.

Yesterday EUR/USD was retesting the 1.1000 level after rising to 1.1003 at the start of the US session and then falling back to a low at 1.0975, but buyers returned and pushed the price above this level again The November and December highs were 1.10087 and 1.10164, respectively, which are the highest levels since early August.

AUD/USD also pushed higher, reaching the highest levels since August, pushing above the critical resistance zone between 0.68 and 0.6820. Passing through this swing area would confirm that this pair has entered the bullish zone.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account