USD Resumes Decline After Unemployment Claims Numbers

Today US Treasury yields turned higher after being on a steep bearish trend since late October. However, the US currency has been finding it

Today US Treasury yields turned higher after being on a steep bearish trend since late October. However, the US currency has been finding it hard to maintain the gains it made earlier in the day as cash flows continue to dominate financial markets as we approach the end of the year.

The US dollar buyers decided to put up a fight earlier in the European session, sending the USD around 70 pips higher across the board, but the bullish momentum ended and it has fallen from its highs of the day. But you cannot really read too much into the price action at this time of the year, since this time is all about flows, and tomorrow is the last day for US tax-loss selling in shares.

The US unemployment claims report was released earlier on, which might have had a negative impact on the USD, sending it lower again. Claims posted a 12K increase last week, to reach a high of 218K, while the previous week was revised higher as well. We continue to remain short on the USD, selling it against major currencies.

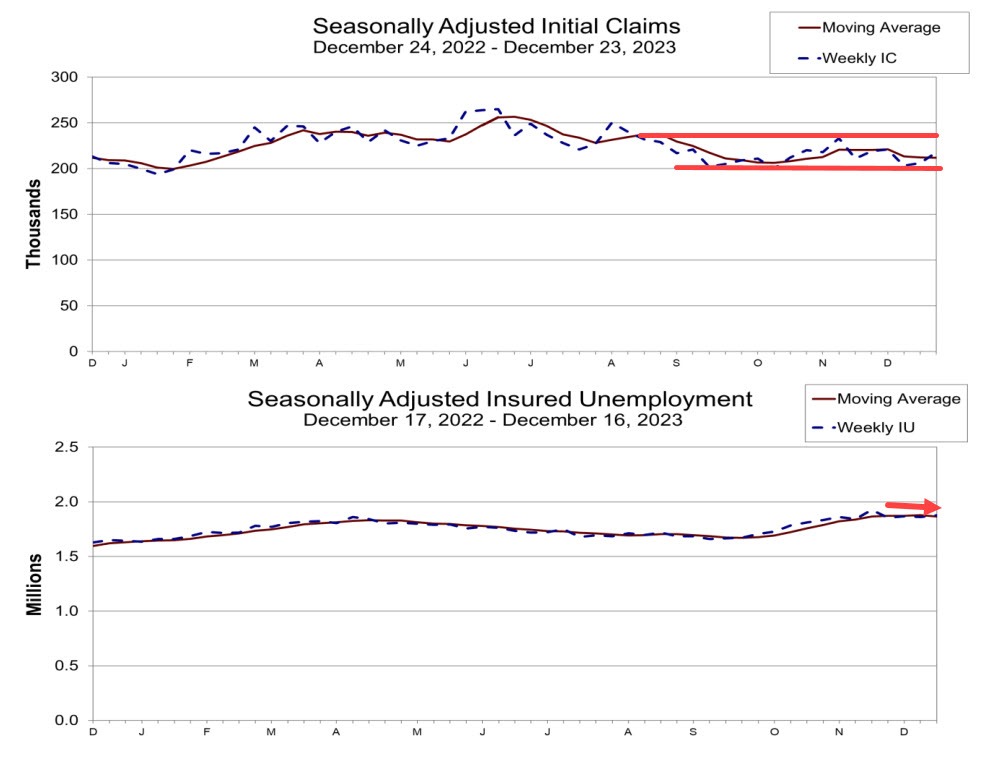

US Initial Unemployment and Continuing Claims Report

- Initial jobless claims 218K vs 210k estimate

- Prior week cailms were 205K revised to 206K

- Initial jobless claims 218K vs 210K estimate

- 4-week moving average of initial jobless claims 212.00K versus 212.25K last week

- Continuing Claims 1.875M vs 1.875M estimate. Prior week 1.865M revised to 1.861M

- 4-week moving average of continuing claims 1.8645M vs 1.877M last week.

- The largest increases in initial claims for the week ending December 16 were in Ohio (+1,304), Oklahoma (+1,029), Michigan (+580), Connecticut (+472), and Massachusetts (+432),

- The largest decreases were in California (-3,834), Georgia (-1,684), Pennsylvania (-588), Arkansas (-541), and Minnesota (-500).

However, in general, around the holidays, initial and continuing claims might be more volatile as holiday jobs swing about in a more volatile pattern.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account