USD Dumps and Recovers Quickly After Better Manufacturing but Softer Prices

Today markets continued yesterday's price action, with USD demand resuming across the board after a dip after JOLTS jobs and Manufacturing..

Today markets started to pick up on yesterday’s price action, with USD demand resuming across the board while risk assets resumed the decline, with US 10-year treasury rates rising above 4% on the day, helping the Buck. The USD demand caused Gold to tumble to $2,030 lows and risk assets to deteriorate further. Commodity currencies are also underperforming, with the AUD/USD falling 0.5% to 0.67 lows as risk trades continue slipping down.

The S&P 500 futures are presently down 0.5%, after larger losses in European stock markets on the day. Major European indices are already down more than 1% as the short squeeze intensifies to begin the new year. We had some important economic data today ahead of the FOMC minutes later in the evening, with JOLTS job openings coming below expectations and below the November numbers, but those were revised higher whic is positive.

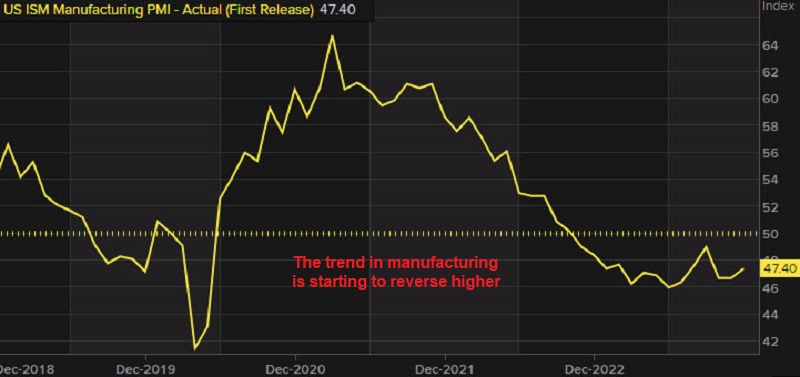

The manufacturing PMI was under scrutiny today, after a further slowdown in ISM manufacturing we saw yesterday, but today’s numbers came above ecpectations, with employment and production improving. But the prices paid continued to decline, which sent the USD down initially, however, the buyers returned and the USD is back up across the board.

ISM Manufacturing PMI Report for December 2023![ISM manufacturing index d]()

- December ISM manufacturing PMI 47.4 points vs 47.1 points expected

- November ISM manufacturing PMI was 46.7 points

- Prices paid 45.2 points vs 49.9 points prior

- Employment 48.1 points vs 45.8 points prior

- New orders 47.1 points vs 48.3 points prior

- Inventories 44.3 points vs 44.8 points prior

- Production 50.3 points vs 48.5 points prior

Comments in the Report:

- Expectation of Stable Interest Rates: The anticipation that the U.S. Federal Reserve will hold off on interest-rate changes is seen as encouraging for companies. This expectation is likely to drive capital investments, as companies may feel more confident in their spending plans.

- Positive Outlook in Computer & Electronic Products: The outlook in the computer and electronic products sector is positive, with the expectation that increased spending on capital investments will drive manufacturing activity.

- Increased Order Intake in Chemical Products: The chemical products industry notes an increase in order intake over the last quarter, leading to a backlog of projects.

- Growing Demand in Transportation Equipment: The transportation equipment sector is experiencing increased demand across the board, resulting in growing back orders.

- Favorable Conditions in Food, Beverage & Tobacco Products: Decreasing commodity costs, readily available supply, and orders at last year’s volumes are noted in the food, beverage, and tobacco products industry.

- Slowing Business in Machinery: The machinery sector reports slowing business conditions, with finished goods inventories growing.

- Optimism in Fabricated Metal Products: A somewhat strong outlook for 2024 is forecasted in the fabricated metal products industry, with mild optimism for the next year.

- Recovery in Primary Metals: Stronger demand is observed in the primary metals sector, particularly from American Automotive OEM customers, following the resolution of the United Auto Workers (UAW) strike.

- Impact of Higher Financing Costs in Wood Products: Higher financing costs have diminished demand for residential investment in the wood products industry, leading to reduced new orders and uncertainty in short-term demand.

- Steady Finish in Electrical Equipment: Electrical equipment, appliances, and components are finishing the year similarly to 2022, with efforts to restore inventory positions.

- Positive Conditions in Miscellaneous Manufacturing: Business conditions are reported as good in miscellaneous manufacturing, with sales and production tracking in accordance with forecasts.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account