Both US Headline and CPI Inflation Beat Expectations in December

Today everyone was waiting for the CPI (Consumer price index) report from the US, which was released a while ago. Inflation has been declini

•

Last updated: Thursday, January 11, 2024

Today everyone was waiting for the CPI (Consumer Price Index) report from the US, which was released a while ago. Inflation has been declining at a considerable speed for about a year, helped by lower Oil prices as well, however, we’re seeing a slowdown, as it approaches normal levels.

The FED has been watching inflation closely in order to decide on the monetary policy, but now inflation reports have started to lose importance. Today we saw an increase in the headline CPI and core CPI for December, but apart from a small jump, there was not much follow-through in the price action. The FX market believes that if bonds are not concerned about inflation, why should forex be too excited? FED funds futures are now pricing in 143 basis points of cuts this year, up from 136 bps an hour earlier.

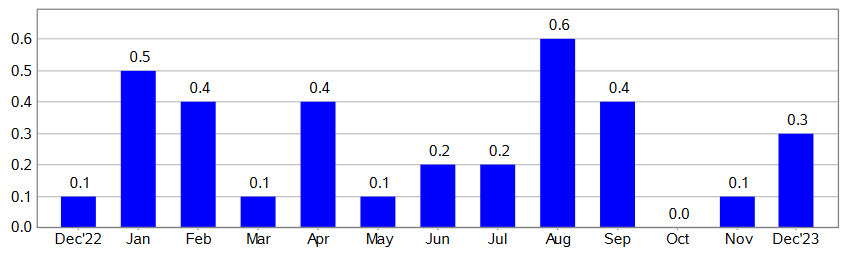

US December 2023 Consumer Price Index Report![US CPI mm]()

Overall CPI:

- December CPI increased by 3.4% year-over-year, exceeding the expected 3.2%.

- November CPI year-over-year was 3.1%.

- Month-over-month (m/m) CPI increased by 0.3%, surpassing the expected 0.2%. The prior month’s m/m CPI was 0.1%.

Core CPI (Excluding Food and Energy):

- Core CPI month-over-month was in line with expectations at +0.3%, consistent with the previous month.

- Core CPI year-over-year was 3.4%, lower than the expected 3.8% and a decrease from the previous month’s 4.0%.

Shelter:

- Shelter prices increased by 0.4% m/m, matching the previous month’s figure.

- Shelter prices year-over-year increased by 6.2%, slightly lower than the prior rate of 6.5%.

Services:

- Services, excluding rent of shelter, increased by 0.6% m/m, consistent with the prior month.

- Year-over-year, services excluding rent of shelter increased by 3.5%, slightly lower than the previous year’s figure.

Core Services Excluding Housing:

- Core services excluding housing increased by 0.4% m/m, slightly lower than the prior month’s 0.44%.

Real Weekly Earnings:

- Real weekly earnings decreased by 0.2%, a decline from the previous month’s increase of 0.5%.

Food:

- Food prices increased by 0.2% m/m, consistent with the previous month.

- Year-over-year, food prices increased by 2.7%, slightly lower than the prior year’s figure of 2.9%.

Energy:

- Energy prices increased by 0.4% m/m, a rebound from the previous month’s decrease of -2.3%.

- Year-over-year, energy prices decreased by -2.8%, an improvement from the prior year’s decrease of -5.4%.

Rents and Owner’s Equivalent Rent:

-

- Rents increased by 0.4% m/m, slightly lower than the prior month’s 0.5%.

- Owner’s equivalent rent increased by 0.5%, consistent with the prior month.

These are some stronger numbers which makes it a hawkish report for the FED, therefore it is not surprising to see some bullish action in the US dollar. However, USD buyers don’t seem confident. The concern is whether the market will look farther ahead and conclude that inflation will fall and that it makes little difference whether the Fed begins cutting in March, April, or June.

EUR/USD Live Chart

EUR/USD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.