The USD Jumps on Lower Jobless Claims Numbers

The previous two trading sessions were quiet once again, with not much on the economic agenda as markets took a respite after the strong act

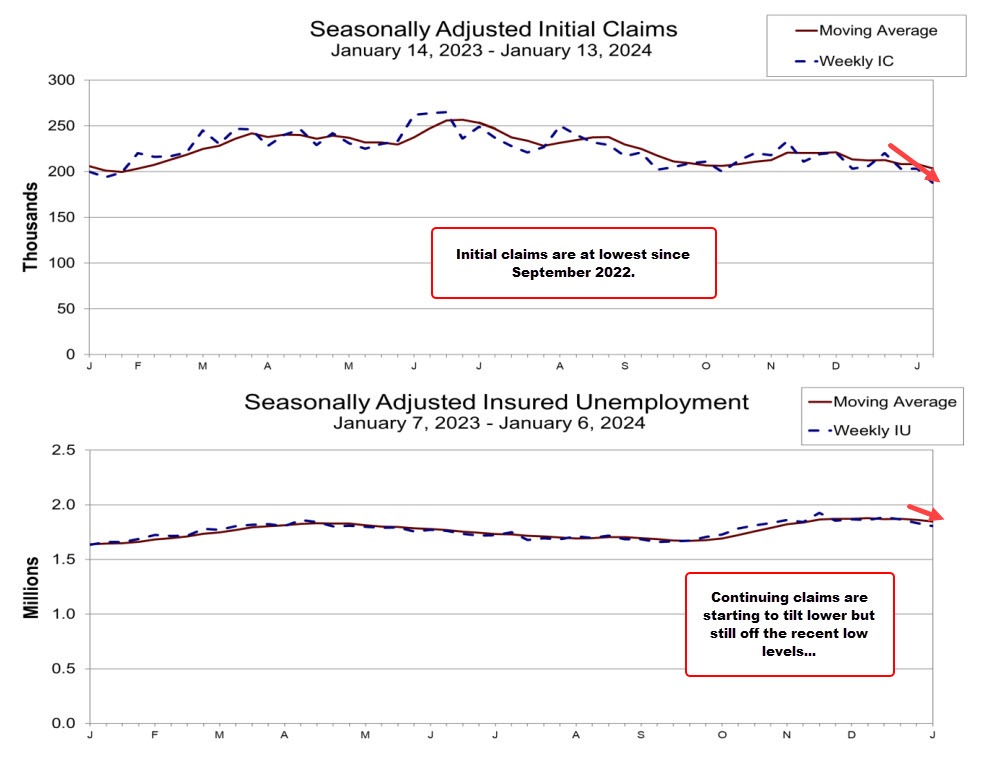

The previous two trading sessions were quiet once again, with not much on the economic agenda as markets took a respite after the strong action yesterday. The action in the bond market after the selloff we saw yesterday after the US retail sales report may be a reason for markets to take a little break with major pairs trading in a tight range. But, the action started after the unemployment claims report from the US showed a decline below 200K.

The USD was retreating slightly lower, with USD/JPY down to 147.60s, however, we saw a quick reversal after the US unemployment claims report, which was released a while ago. Jobless claims showed a decline below 200K, which is considered a strong reading. This is a strong report. It coincides with the BLS survey week for the upcoming jobs report.

US Initial and Continuing Jobless Claims

Initial Jobless Claims:

- Initial jobless claims for the week were 187,000, which is lower than the estimated 207,000.

- This marks the lowest level since September 24, 2022.

- The prior week’s initial claims were revised from 202,000 to 203,000.

- The 4-week moving average stands at 203,250, down from the previous week’s revised figure of 208,000.

Continuing Claims:

- Continuing claims for the week were 1.806 million, which is lower than the estimated 1.845 million.

- The prior week’s continuing claims were 1.834 million.

- The 4-week moving average for continuing claims is 1.848 million, down from the previous week’s figure of 1.862 million.

Regional Changes in Initial Claims:

-

- The largest increases in initial claims for the week ending January 6 were in New York (+20,535), California (+9,454), Texas (+9,337), Georgia (+6,261), and South Carolina (+4,152).

- The largest decreases were in New Jersey (-4,044), Massachusetts (-3,341), Connecticut (-2,896), Iowa (-1,847), and Pennsylvania (-1,566).

The USD jumped around 20-30 pips higher across the board, with Gold falling around $8 to $2,008. However, the situation is reversing as the Buck gives back the gains. But, the Philadelphia FED Business index for this month indicated a decline to -10.6 points vs -7.0 points expected, showing that there are still many weak spots in the USD economy. We booked profit on GBP/USD shorts, but the EUR/USD and NZD/USD signals just missed the take profit targets by a few pips.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account