GBP/USD Finds Buyers at MAs on Every Dip

The USD has been making a comeback this month, however looking at the GBP/USD chart, you cannot really see a trend reversal. It rather looks

The USD has been making a comeback this month, however looking at the GBP/USD chart, you cannot really see a trend reversal. It rather looks like a retrace before the uptrend resumes again, with all dips being bought. Buyers continue to keep the price above 1.26 and the lows are getting higher, which indicates that the pressure remains to the upside.

This forex pair saw high demand in the last two months of 2023, gaining nearly 8 cents until late December, as the Bank of England kept a hawkish bias, while the FED started signaling policy easing is coming soon, which sent the USD plummeting. The FED reinforced the dovish bias at last week’s meeting, announcing plans to start cutting interest rates, with markets expecting the first cut to come in March, giving this pair an additional lift higher.

The Bank of England on the other hand seems to be holding its restrictive position, refraining from giving any rate cut signals, which is keeping GBP/USD supported. Despite the recent USD comeback, this pair is holding the gains and remains above the 200 SMA (purple) on the daily chart, which continues to hold as support.

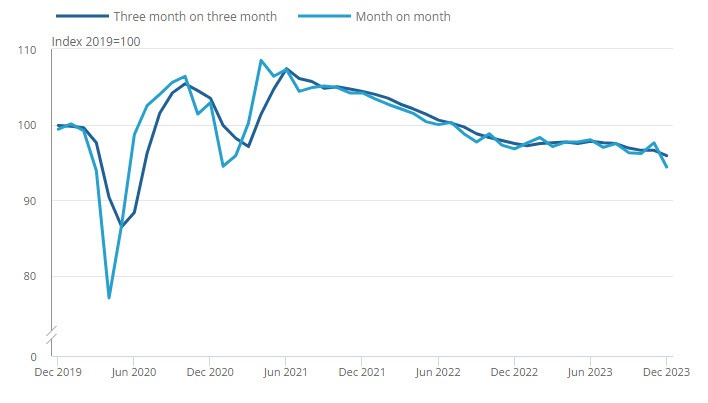

This week the UK consumer inflation report showed an increase to 4.0% for December from 3.9% in November, while core CPI held steady at 5.1%, defying market predictions of a 2-point drop to 4.9%. That gave the GBP a boost despite the cool-off in wages/earnings earlier this week. Today we had the retail sales report, with the headline number expected to show a decline of 0.5%, returning to the negative trend, after posting a 1.3% jump in November, which was likely due to Black Friday.

UK Retail Sales Report for December

- December retail sales month-over-month (MoM) decreased by -3.2%, significantly lower than the expected decline of -0.5%.

- November retail sales MoM were initially reported at +1.3% and have been revised to +1.4%.

Year-over-Year Retail Sales:

- December retail sales year-over-year (YoY) decreased by -2.4%, contrasting with the expected growth of +1.1%.

- The prior month’s YoY figure was initially reported at +0.1% and has been revised to +0.2%.

Retail Sales Excluding Autos and Fuel:

- Retail sales excluding autos and fuel MoM decreased by -3.3%, well below the expected decline of -0.6%.

- November retail sales excluding autos and fuel MoM were initially reported at +1.3% and have been revised to +1.5%.

Year-over-Year Retail Sales Excluding Autos and Fuel:

- Retail sales excluding autos and fuel year-over-year (YoY) decreased by -2.1%, diverging from the expected growth of +1.3%.

- The prior month’s YoY figure was initially reported at +0.3% and has been revised to +0.5%.

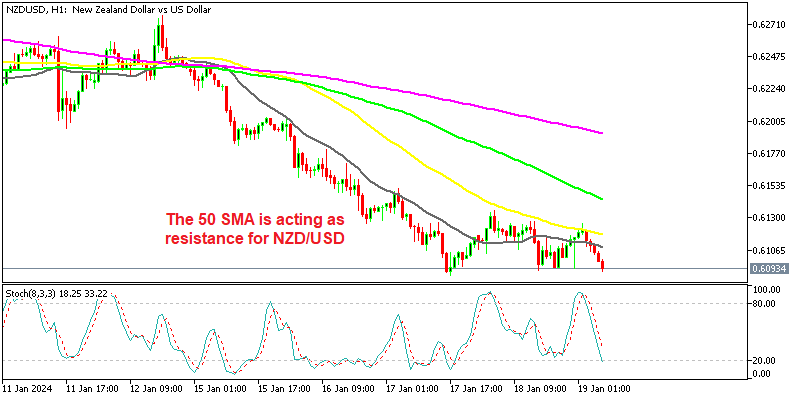

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account