NZD/USD Keeps Returning Below 0.61, With Economic Data Not Helping

The NZD has turned quite bearish this week after being quite bullish in Q4 of last year, as commodity dollars benefited while the USD...

The NZD has turned quite bearish this week after being quite bullish in Q4 of last year, as commodity dollars benefited while the USD turned negative on Dovish FED rhetoric. The NZD rode the wave of the positive risk attitude and rose over 0.63 by the end of last month, but it has lost more than 250 pips during these first three weeks of the new year, with the price falling to the support zone below 0.61. However, this is a strong support zone where sellers are finding difficulty pushing the price below.

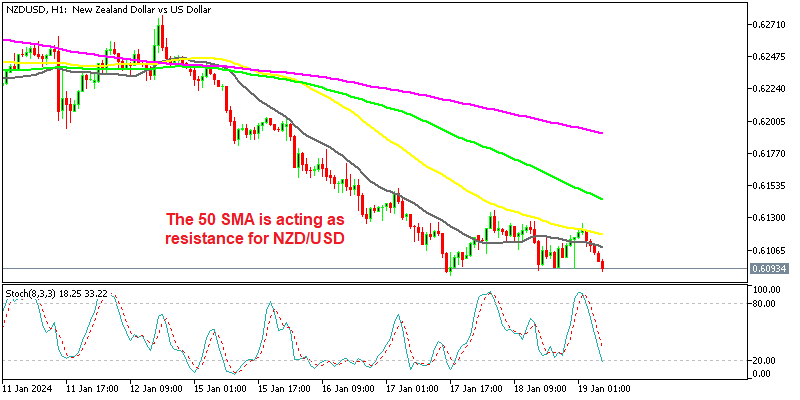

NZD/USD H1 Chart – The 50 SMA Keeping the Trend Berish

The price returns below 0.61 again

US Economic Data Remains Upbeat

Several positive economic reports from the US have improved the outlook for the USD, making the market reconsider the path of policy easing by the Federal Reserve. The US CPI inflation YoY increased by two points to 3.4% in December, exceeding the market consensus of 3.2%, while the Core CPI beat expectations of 3.8% and came at 3.9%.

On Wednesday we had the retail sales report from the US, which came stronger than expected. They increased by 0.6%, increasing the pace of spending from the US consumer expenditure from the 0.3% gain in November, despite Black Friday sales. Yesterday, the unemployment claims from the US fell below 200K, an increase in US retail sales is expected to support Federal Reserve (Fed) policymakers’ stance of keeping interest rates low for a longer duration than market participants anticipated. Initial unemployment claims fell to 187K, coming 20k lower than the projected 207,000. The four-week moving average also came down to 203K from the previous week’s revised value of 208K.

Soft Data from China and New Zealand Not Helping

On the other hand, the sentiment in the financial market remains pessimistic overall, after some soft economic numbers from China yesterday. Yesterday the retail sales report showed a slowdown to 7.4% from 10.1% previously, while the GDP failed to meet expectations of 5.23%, coming at 5.2% instead.

The economic numbers from New Zealand are not painting a positive picture either, which is weighing on the Kiwi. The New Zealand GDP results in December remained lackluster, while house prices fell by 0.7% year on year in December, according to data released this week. Yesterday, New Zealand’s manufacturing PMI index showed a decline from 46.5 to 43.1 points in December, with this sector being in contraction for almost a year. So, NZD/USD remains bearish and moving averages are acting as resistance on the H1 chart, as shown above

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account