Moment of Truth for the USD Buyers After Friday’s Retreat, as FED Rate Cuts Odds Fall

Early last year the market was expecting the FED to announce the start of policy easing in 2023 but that didn't happen and the Buck...

Early last year the market was expecting the FED to announce the start of policy easing in 2023 but that didn’t happen and the Buck remained bullish for most of the summer until October, when the FED did start to give dovish signals. Markets saw through this and the USD tumbled lower, with the FED confirming the expectations, which sent treasury yields crashing lower. However, January has been pretty strong for the USD and the Buck has made some decent gains.

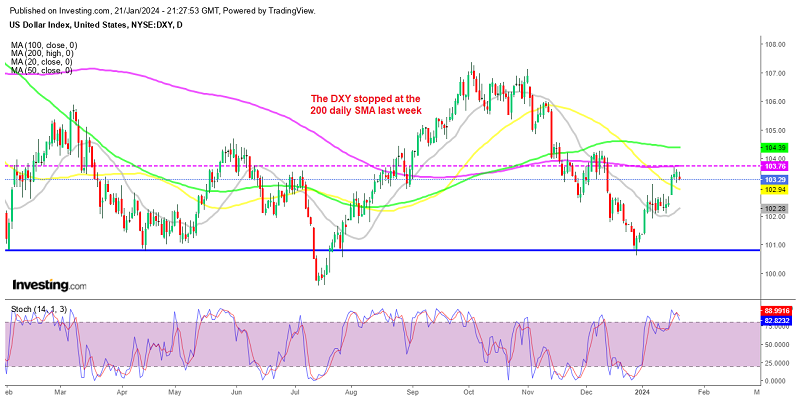

US Index DXY Daily Chart – The Climb Has Stopped at the 200 SMA

The story of this month so far has been that of a stronger US economy as the data has been showing, which has pushed up bond yields. US 10-year yields have risen to 4.16% from below 3.80% late last month. The market right now is feeling more confident that the US economy will avoid recession and hold up well, and it also raises questions about how far the Federal Reserve will go with rate cuts.

The Market’s Pricing for FED Cuts Has Declined

Until a few weeks ago, the market had priced in around 167 bps of easing this year, but that has decreased to 130 basis points as the market expects greater patience from the FED and fewer ‘safety’ cuts. But with US stock markets at all-time highs, the FED has fewer reasons to hold on.

However, market odds at the moment for a March cut stand at 47 basis points, for a May cut at 30 basis points, a June cut at 53 basis points, and a July cut at 74.6 bps. September is set at 95 bps, with November at 114 bps. This is the first time the odds for a March cut have fallen below 50% this year, having previously been at 100% in December. The FED funds dot plot indicates three cuts for the full year.

Encouraging Signs from the US Economy

This has improved the sentiment for the USD and has turned risk currencies bearish, especially with the diverging economics as the economic data is showing. The Eurozone, UK, and Canadian economies are softening further while the US economy is showing signs of improving. So, we might end up with more rate cuts by other major central banks than the FED by the end of the year, which is what the market is fearing right now and is keeping the USD bullish. So, we are buying the dips in the USD as long as the economic data is strong.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account