USD/JPY Consolidating Around 138 Awaiting the BOJ Tomorrow

This week we have three major central banks on the agenda, apart from the PBOC which kept the LPR unaltered early today.

This week we have three major central banks on the agenda, apart from the PBOC which kept the LPR unaltered early today. It kicks off with the most important event, which is the Bank of Japan meeting, to b followed by the Bank of Canada meeting on Wednesday, and the European Central Bank meeting on Thursday. As a result, most pairs are trading in a narrow range.

As such, markets might be experiencing some elevated volatility in the days ahead after getting past the disappointing start to the week today. The Bank of Japan fell back quickly to its current stance, after a hawkish tilt in December which didn’t materialize. Now, with inflation falling and the Ishikawa earthquake, it is certain that the BoJ’s policy settings are unlikely to alter abruptly. They previously cited the spring salary hikes before taking their next steps, and they will probably repeat the same theme tomorrow.

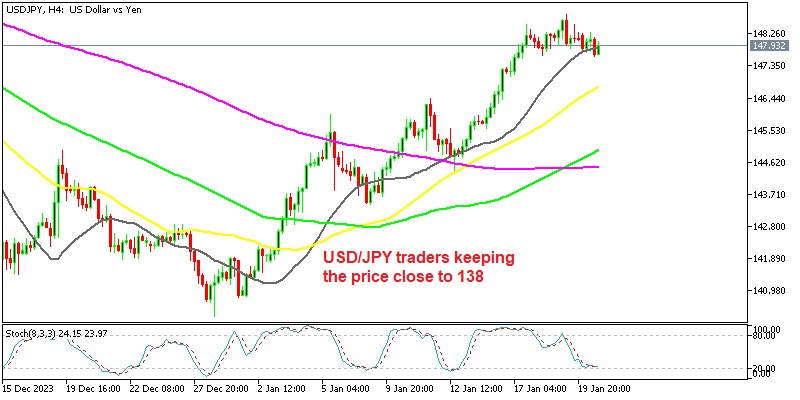

USD/JPY H4 Chart – Traders Keeping It Close to 1.48

So, traders are reluctant to take any sides in USD/JPY right now. Although, if the BoJ remains the same rhetoric, then that should be bearish for the JPY, so bullish for this pair. In the European session, the Japanese Prime Minister also made an appearance, commenting on the economy.

Remarks by Japanese Prime Minister, Fumio Kishida

- We’re at a critical juncture to escape from deflation

- Growth is outpacing prices needed for virtuous cycle

- Will work on steps to pass on labour costs on to consumers

- Wage hikes at small and medium-sized businesses are essential

The public sector, as well as larger enterprises, will raise salaries in spring. However, Japan may be concerned about the ability of smaller enterprises, particularly those in less densely populated areas, to deliver on the same level. If the discrepancy widens over the following few cycles, it could become a bigger concern for Japan in the coming years.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account