USD/CAD Back Up at 1.35 With the BOC Not Planning to Hike Anymore

USD/CAD lost around 8 cents during the last two months of 2023 but reversed at the very end and has been forming a bullish trend this month.

USD/CAD lost around 700 pips during the last two months of 2023 but reversed at the very end and has been forming a bullish trend this month. the economic data from the US has been helping push the USD higher, while the Bank of Canada (BOC) didn’t have much impact on the CAD despite standing firm against any policy easing soon, sending USD/CAD close to 1.35.

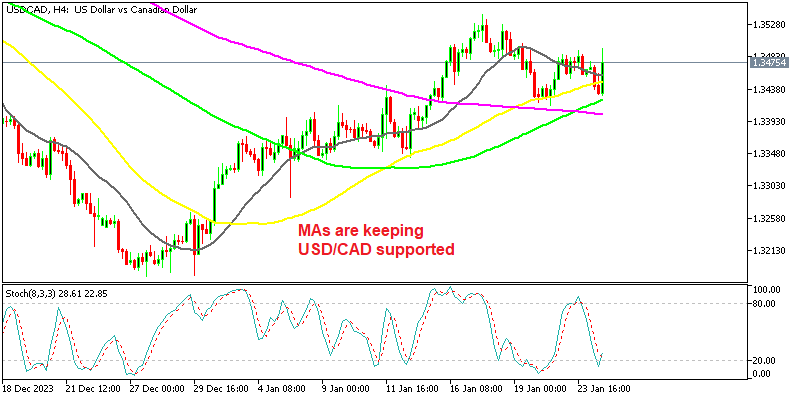

The economic data from the US has been pretty upbeat in January, which has forced the market to reconsider the depth of the FED cuts. That has been fuelling this in the last 3-4 weeks and the price has moved above all moving averages on the H4 chart, which had previously served as resistance. Now those moving averages have turned into support for USD/CAD , providing good buying opportunities for buyers.

USD/CAD H4 Chart – Buyers Entering at Moving Averages

The economy of Canada on the other hand has been showing weakness, particularly the Canadian consumer, however, inflation has remained sticky in recent months, which is keeping the Bank of Canada’s (BOC) still on the hawkish side. Today’s rate announcement showed that the BOC is not thinking about hiking anymore, which is the first step toward the dovish side.

Bank of Canada Rate Decision and Statement Highlights

- Interest Rates:

- BOC held interest rates unchanged at 5.00%, as was widely expected.

- The market had priced in a 15% chance of a rate cut.

- Concerns about Inflation:

- BOC expressed continued concern about risks to the outlook for inflation, particularly the persistence in underlying inflation.

- Change in Forward Guidance:

- The BOC statement no longer includes the phrase “remains prepared to raise the policy rate further if needed,” signaling a potential shift in the central bank’s stance.

- Economic Growth and Outlook:

- The Canadian economy experienced a stall since the middle of 2023, with growth expected to remain close to zero through the first quarter of 2024.

- Economic growth is anticipated to strengthen gradually around the middle of 2024.

- BOC forecasts GDP growth of 0.8% in 2024.

- Inflation Outlook:

- BOC expects inflation to remain close to 3% during the first half of this year before gradually easing, returning to the 2% target in 2025.

- Core measures of inflation are not showing sustained decline.

- The forecast for 2.8% inflation this year is down from 3.0% in October.

- Core Inflation:

- The BOC mentioned the necessity to see further and sustained easing of core inflation.

- Consumer Sentiment:

- Consumers have pulled back their spending in response to higher prices and interest rates.

- Labor Market Conditions:

- Labor market conditions have eased, with job vacancies returning to near pre-pandemic levels. New jobs are being created at a slower rate than population growth.

- Policy Consensus:

- There was a clear consensus to maintain the policy rate at 5%.

USD/CAD jumped hgiher as the CAD slipped lower, however there was some impressive data coming out at the same time, which have also impacted the US Dollar. The BOC’s decision to remove the previous comments which showed a willingness to raise interest rates further, implies a potential relaxation of monetary policy in the coming months. However, BOC Governor Macklem stated that, while the central bank has not committed to future rate hikes, additional increases may be required if inflation rises. However, inflation is anticipated to decrease again, forcing the Bank of Canada to seriously consider an April rate cut.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account