EUR/USD Stalls at 1.0877 as Forex Traders Brace for Upcoming US GDP and ECB Conference

A variety of economic indicators influenced the EUR/USD pair's trading range on Thursday, which was around 1.0877.

The EUR/USD pair hovered around 1.0877 on Thursday, influenced by a mix of economic indicators. Notably, European PMI data displayed strength in the manufacturing sector, surpassing expectations, while comprehensive U.S. PMI figures exceeded forecasts, dampening the initial enthusiasm for the Euro and bolstering the U.S. Dollar’s appeal as a refuge.

Manufacturing Data Impacts Euro Amidst Contrasting PMIs

In Europe, while manufacturing PMI showed unexpected growth, rising to 46.6 against a predicted 44.8, the service sector failed to meet forecasts, hinting at ongoing economic challenges. Conversely, the U.S. presented a robust economic outlook with manufacturing PMI hitting an 11-month peak at 50.3 and services PMI also outperforming expectations.

The Euro initially saw gains against the Dollar as markets reacted positively to the manufacturing news, despite overall PMI figures remaining in contraction territory. Across the pond, the strong performance of the U.S. economy suggested by the PMI data is tempering expectations for imminent Federal Reserve rate cuts.

This shift in sentiment is reflected in market projections, with the likelihood of a March rate reduction by the Fed now significantly reduced, as per the CME’s FedWatch tool.

What’s Next?

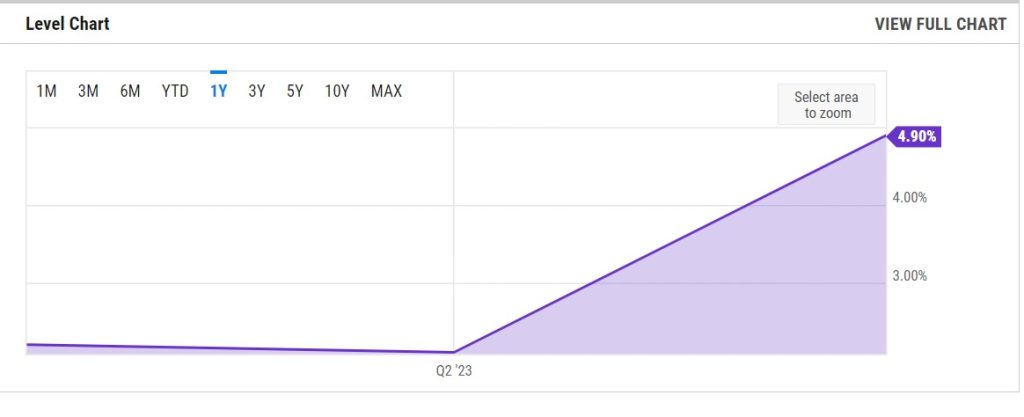

Ahead of a packed economic calendar, the EUR/USD pair faces potential volatility. The U.S. is set to release its Advance GDP figures, with a forecasted slowdown to 2.0% from the previous 4.9%. Markets will also digest U.S. unemployment claims, anticipated at 199K, slightly up from 187K.

The Advance GDP Price Index is expected to decelerate to 2.3% from 3.3%, which could influence dollar strength.Meanwhile, Core Durable Goods Orders might show a modest increase, and the wider Durable Goods Orders are projected to see a significant uptick.

The Goods Trade Balance figures will be under scrutiny, with an anticipated slight improvement. Additionally, the European Central Bank’s press conference is likely to steer the Euro’s trajectory, providing critical insights into the region’s monetary policy outlook.

EUR/USD Technical Outlook

The EUR/USD pair is exhibiting a consolidation pattern, trading near the pivot point at 1.08962. Technical indicators reveal a struggle for direction as the pair navigates between established resistance and support levels.

Resistance is seen at 1.08969, 1.09509, and 1.09969, each level setting a ceiling for potential upward movements. On the flip side, the currency pair finds immediate support at 1.08757, with additional support levels at 1.08222 and 1.07750.

The Relative Strength Index (RSI) hovers around the midline, indicating a neutral momentum without a clear sign of a decisive move in either direction. The pair’s close adherence to the pivot point underscores market indecision, with traders likely eyeing economic catalysts for directional cues.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account