Finally Some Good News from Europe, After Positive Q4 GDP Revisions

The market sentiment is mixed today, which shows uncertainty ahead of central bank meetings this week. EUR/USD made some strong gains though

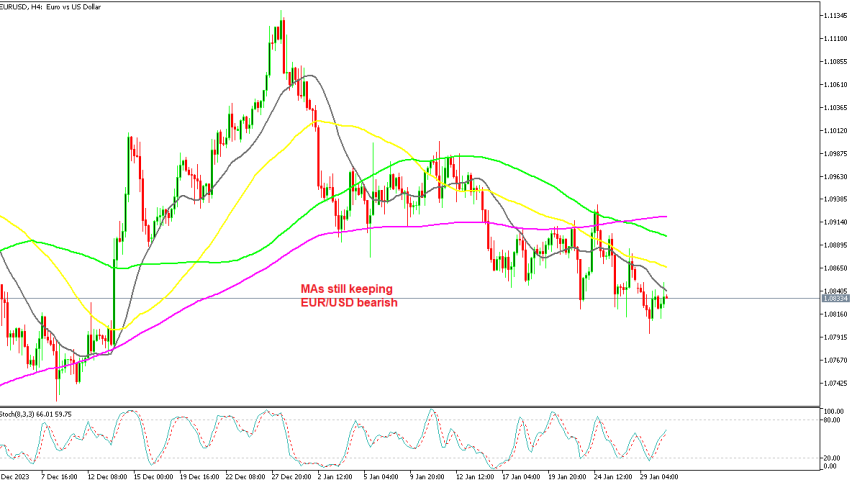

The market sentiment is mixed today, which shows uncertainty ahead of central bank meetings this week. Major forex pairs are bouncing in a tight range, with the USD retreating earlier but is pushing back up now, as the spotlight this week remains on the FED’s decision which is scheduled for tomorrow evening. tomorrow. The Euro has shown some resilience though, making decent gains against most currencies.

EUR/USD slipped lower earlier in the morning as it fell briefly to 1.0812 before returning back up to reach 1.0850. Yesterday the Euro was weaker than most currencies due to rate cut comments by ECB members, which continued today. But, the GDP numbers from the Eurozone helped the sentiment for the Euro. This follows a flood of GDP figures in the European session, which confirmed lackluster growth in the fourth quarter of last year, however, it wasn’t as bad as previously thought.

The French and German economies exhibited symptoms of weakness once again, as both shrank again. However, this was compensated by better growth in the periphery countries, which means that the Eurozone economy barely avoided a recession. That is keeping the Euro bullish today, however the main trend in EUR/USD still remains bearish.

European Q4 GDP Revisions

- Eurozone Q4 preliminary GDP QoQ 0.0% vs -0.1% expected

- Prior Q4 GDP reading was -0.1%

- Germany Q4 preliminary GDP QoQ -0.3% vs -0.3% expected

- Prior Q4 GDP reading was -0.1%

- France Q4 preliminary GDP QoQ 0.0% vs 0.0% expected

- Prior GDP was -0.1%; revised to 0.0%

- Italy Q4 preliminary GDP QoQ +0.2% vs 0.0% expected

- Prior GDP reading was +0.1%

- Spain Q4 preliminary GDP QoQ +0.6% vs +0.2% expected

- Prior +0.3%; revised to +0.4%

The Eurozone economy narrowly avoided a recession in the fourth quarter of 2023. This is partly due to faster growth in peripheral nations, particularly Spain and Portugal and to some degree Italy. The more optimistic performances there helped to counterbalance the bad performance in the region’s largest economy.

The German economy, on the other hand, contracted again in the fourth quarter of last year, confirming a recession. The annual GDP growth rate is expected to be -0.4% unadjusted, and -0.2% adjusted. That portrays a bleak image for Europe’s largest economy, with the forecast for this and the next year not looking promising either.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account