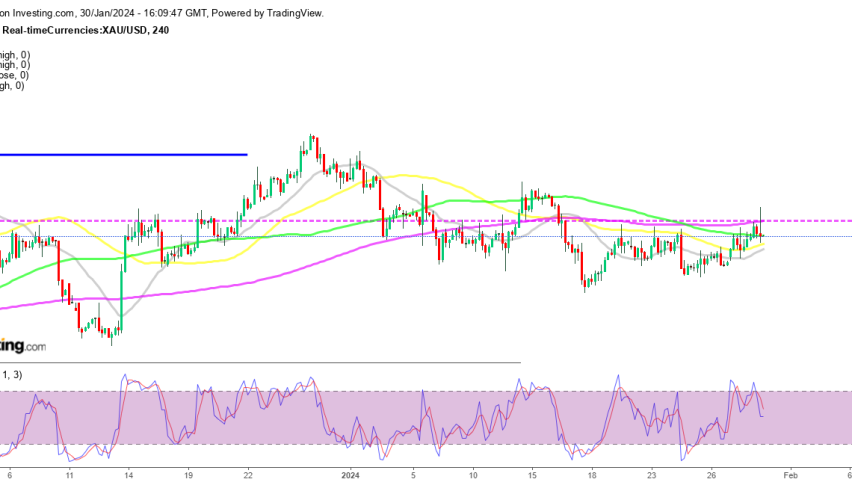

Gold Price Declines $20 Lower After Another Failure at the 200 Daily SMA

This week the Gold price has been seeing some upside momentum, with its value rising by more than around 1.5%, to the daily highs at $2,050

This week the Gold price has been seeing some upside momentum, with its value rising by more than around 1.5% up to the daily highs just below $1,950 earlier today. The Middle Eastern tensions have been fueling this increase, however with the FOMC meeting coming tomorrow and the positive economic data from the US which keeps coming, Gold buyers don’t seem too confident right now.

XAU/USD gained around $10 yesterday on geopolitical stress and the probability of the FED further cutting interest rates in March, and is up another $16 today, reaching $2048,60s which is the best level in Gold in the last two weeks. Gold has historically experienced strong bids in January and February with demand picking up ahead of the Chinese New Year celebrations, however, this year seems different, with central banks planning to reverse policy and start cutting rates soon.

Will the FED Be Hawkish or Dovish for the Gold Price Tomorrow?

But, with the positive economic figures from the US this month, markets are now reconsidering the policy path from the FED this year, after turning quite dovish on the FED in December. So, this has sparked a US dollar purchasing and increasing Treasury yields this month. However, this meeting can go both ways, which is preventing buyers and sellers from pushing the price on either side.

Geopolitics and China Worries Keeping Gold Demand Up

Although, geopolitical risks remain high, with the possibility of the US attacking Iran, which was why Gold was bullish in the last two days. But it looks like the US will refrain from such action which puts the risk on the downside. However, you never know, so we’re being cautious and waiting for retraces to end before buying or selling.

The relative slowdown in the Chinese and the global economy has been one of the reasons for the bullish momentum in Gold which sent it to all-time highs in early December, and with Evergrande ordered to be liquidated by a Hong Kong court yesterday, the sentiment regarding the economy of China is not the best at the moment. This uncertainty increases demand for gold’s safe-haven allure.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account