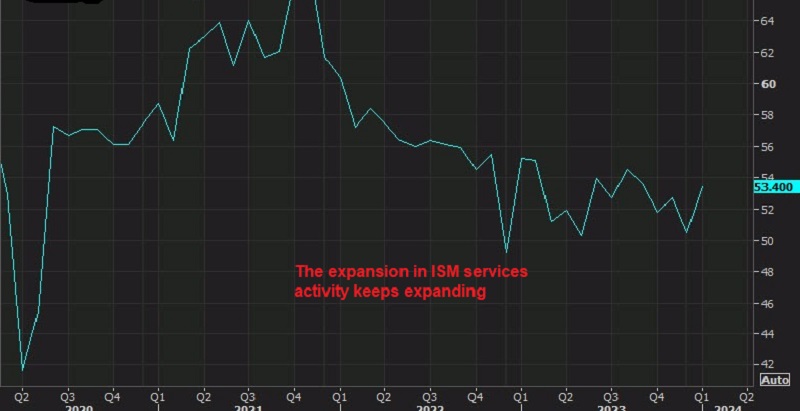

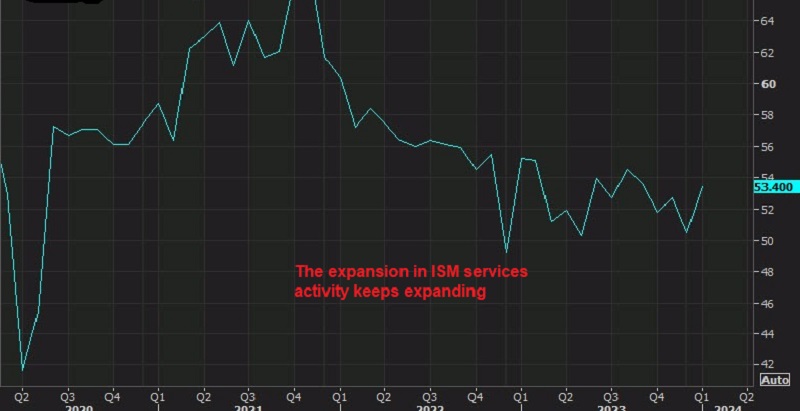

US Economy Heating Up on All Fronts, As ISM Services Jump

The US economy has been showing plenty of signs that it is going to have a great year in 2024, totally the opposite of what analysts were ex

The US economy has been showing plenty of signs that it is going to have a great year in 2024, totally the opposite of what analysts were expecting until recently. The ISM services posted a nice jump for January, killing any remaining fears of a recession.

As a result, the USD continues to move higher, with USD/JPY trading at 148.60s as it moves back toward the 149 zone which is a decent resistance area. EUR/USD continues to slip lower, printing a new low at 1.0720. Sellers remain in charge of GBP/USD as well, pushing the price to a new low at 1.2518. In the US debt market, 10-year Treasury yields are trading 15 basis points higher at 4.18%, while 2-year yields are up by 10 basis points at 4.50%.

ISM Services PMI for January 2024

- Services PMI for January 53.4 points versus 52.0 points estimate

- December services PMI were 50.5 points

- ISM nonmanufacturing PMI 53.4 points versus 52.0 points estimate

- Nonmanufacturing business activity January 55.8 vs 55.8 last

- Employment.50.5 points vs 43.8 points last month

- New orders 55.0 points vs 52.8 points last month

- Prices Paid 64.0 points vs 57.4 points last month

Other components:

- Services PMI:

- January: 53.4 points

- Estimate: 52.0 points

- December: 50.5 points

- Services Business Activity:

- January: 55.8 points

- Expectations: 55.8 points

-

- Employment:

- January: 50.5 points

- Last Month: 43.8 points

- New Orders:

- January: 55.0 points

- Last Month: 52.8 points

- Prices Paid:

- January: 64.0 points

- Last Month: 57.4 points

Other Components:

- Inventories:

- January: 49.1 points

- Last Month: 49.6 points

- Supplier Deliveries:

- January: 52.4 points

- Last Month: 49.5 points

- Backlog of Orders:

- January: 51.4 points

- Last Month: 49.4 points

- New Export Orders:

- January: 56.1 points

- Last Month: 50.4 points

- Imports:

- January: 59.9 points

- Last Month: 49.3 points

- Inventory Sentiment:

- January: 59.3 points

- Last Month: 55.3 points

Main Comments from the Respondents

“Supply chain disruptions forced a change to min/max (inventory calculations) to assure on-time materials; now that most disruptions are over, those calculations are being normalized, which will slow down ordering while inventories right-size. The district is seeing higher-than-normal turnover as workers are being aggressively pursued by districts offering higher wages. Water sales are lower than expected due to unseasonably cool weather. This will put pressure on rates, along with an increase in wages in order to attract and retain quality employees.” [Utilities]

“Transportation impacts of the Suez Canal, due to unrest in the Red Sea and the issues at the Panama Canal are impacting both costs and schedules for the transport of global goods.” [Construction]

“Last year was tough for our business. We are hoping that the economy improves and things stabilize in 2024. It’s a presidential election year, so we’re hopeful.” [Wholesale Trade]

“Economy signals are mixed. Some sectors are booming and some — like solar and wind power, ship building and electric vehicles — are slowing down. Other downward-trending sectors are iron and steel, paper and communication equipment. But overall, the economy is in good shape and there is no imminent threat of a recession.” [Retail Trade]

“Economic indicators generally look good; however, there is still some uncertainty. We continue to see more demand for our services, but this may not be indicative: Our services are always more in demand when the economy is worse than when it is better. It would be amiss not to mention that we are still seeing the effect of people returning to offices, which impacts demand. Though demand has continually increased, it is not at pre-pandemic levels.” [Transportation Equipment]

“Increase in activity; expecting a busy 2024.” [Finance & Insurance]

“Most companies I work with are gearing up for a tough 2024. Some may be overreacting, but there is a general sense that election years in the U.S. result in unrest, which is causing everyone to be conservative with spend.” [Professional, Scientific & Technical Services]

“The writers and actors strike has impacted our business significantly. This will not be a great year for movie exhibitors.” [Arts, Entertainment & Recreation]

“Respiratory sicknesses — COVID-19, RSV (respiratory syncytial virus) and flu — continue to keep our facility hopping to treat patients.” [Health Care & Social Assistance]

“(Looking to rebound) after a significant downturn in December, which was likely due to extended plant shutdowns, customer inventory burns and lingering effects from the United Auto Workers (UAW) strike.” [Wholesale Trade]

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account