US Job Market Remains Solid, the US Real Estate Sector Not So Much

The job market in the US remains one of the strongest sectors, but real estate seems to be in trouble as Yellen confirmed

The job market in the US remains one of the strongest sectors, with unemployment claims near cycle lows, while new jobs keep increasing at a very fast pace. However, we can’t say the same for the real estate sector, which went through a crisis last year, inducing the regional banking crisis, and this year we are seeing similar symptoms.

Janet Yellen, the former Federal Reserve Chair, spoke on the commercial real estate sector, predicting losses and difficulties in the industry. However, she expressed confidence that these difficulties do not represent a systemic risk or need a crisis. Yellen noted that commercial real estate concerns will endure and might have a long-term impact on the economy.

Regarding interest rates, Yellen stated that most forecasters and the Congressional Budget Office (CBO) predict a drop in US interest rates. This outlook is consistent with wider market sentiment and economic expectations. Shortly before Yellen’s speech, the Unemployment Claims report for last week was released, showing that this sector remains stable overall.

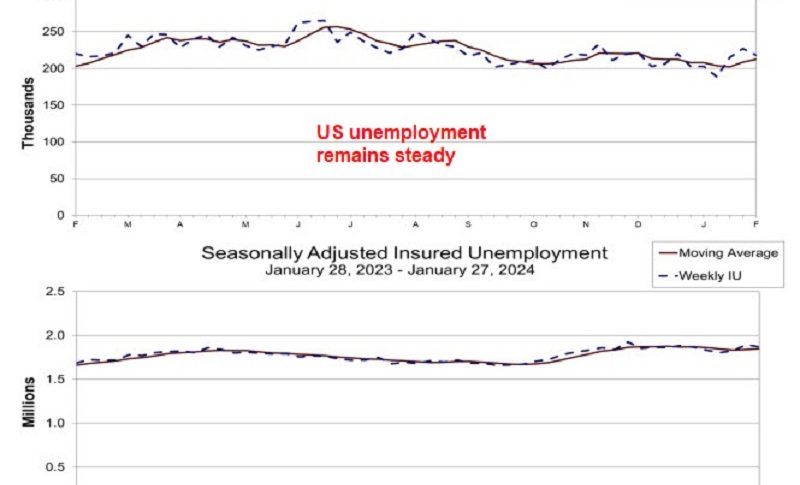

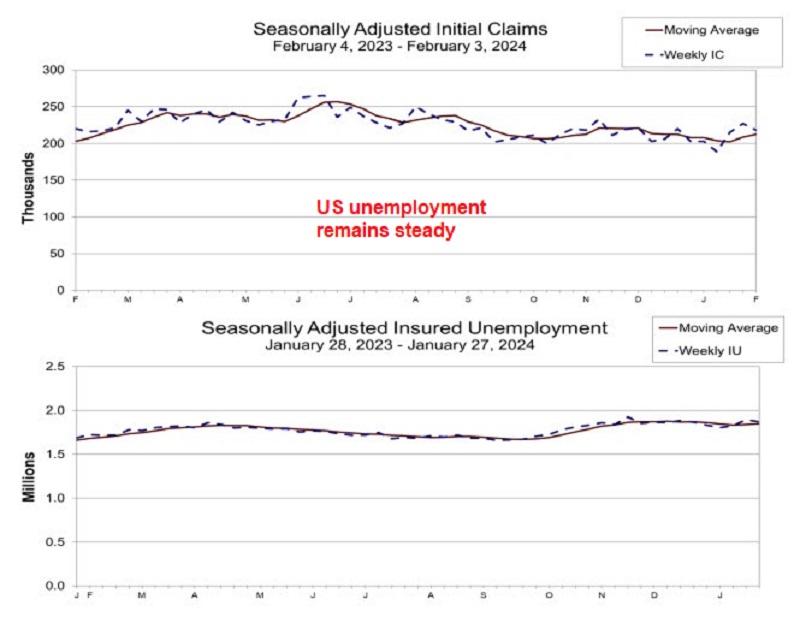

The US initial and continuing jobless claims

- Initial jobless claims came in at 218K, slightly below the estimate of 220K. The prior week’s figure was revised from 224K to 227K.

- The 4-week moving average of initial jobless claims stands at 212.25K, compared to the revised figure of 208.30K from the previous week.

- Continuing claims totaled 1.871M, slightly lower than the estimate of 1.878M. The prior week’s figure was revised from 1.894M to 1.898M.

- The 4-week moving average of continuing claims is 1.850M, compared to 1.840M in the previous week.

- Among the states, the largest increases in initial claims were seen in Oregon (+5,458), California (+5,015), New York (+4,133), Georgia (+1,032), and Texas (+900).

- On the other hand, the largest decreases in initial claims were observed in Illinois (-2,278), Missouri (-1,588), Massachusetts (-898), Montana (-717), and New Jersey (-507).

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account