Expectations for January Inflation Rate – Prepare for Huge Forex Moves

January's US inflation rate will be important for USD traders, with the FED looking at the CPI numbers closely

With the US employment sector being in a strong position and the rest of the economy stabilizing, the attention of the FED has shifted to the inflation figures. Inflation has been on a declining trend, however in December we saw a jump in the CPI which has altered FED rate cut projections, so that makes today’s CPI report extra important for the FED and the USD.

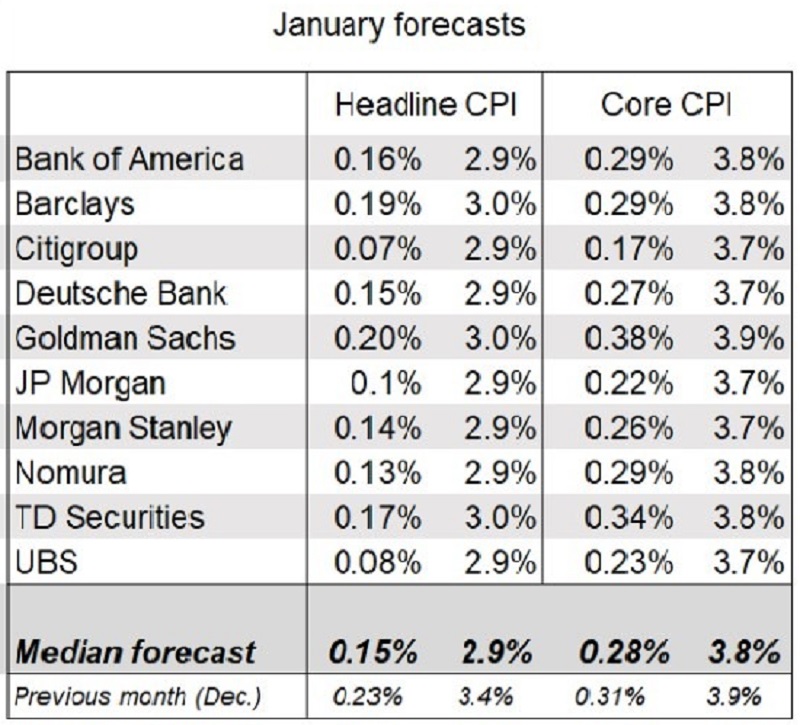

The headline CPI YoY is anticipated to lose 5 points, falling to 2.9% from December’s 3.4%, while the monthly CPI is anticipated to show a 0.2% increase. However, traders are looking at the core CPI mostly, with expectations for a fall to 3.7% on an annualized basis, from 3.9% in December. That is expected to be accompanied by a +0.3% monthly core CPI.

January US Inflation Expectations

The US economy is performing well in terms of employment and inflation has been on a downward trend, with employment remaining strong. The Fed’s challenge now is when to start cutting interest rates. Lowering rates would stimulate economic activity but might exacerbate inflation while keeping rates high could potentially dampen economic growth. The Federal Reserve is in between maintaining/increasing economic growth and addressing inflation. But when faced with divergent trends in economic indicators, this becomes harder, although they will cut either in May or June.

The market’s current pricing indicates a 70% probability of the first interest rate cut occurring during the May meeting, although this timeline could potentially be pushed back to the next meeting in June. This suggests that investors are anticipating a shift in the Federal Reserve’s monetary policy stance towards easing, but the traders are playing/trading the exact date, given the robust state of the US economy, coupled with declining inflation. The issue for the FED lies in finding the appropriate middle ground.

The timing and extent of any interest rate cuts will likely depend on incoming economic data, particularly indicators related to inflation and employment. The FED will also need to carefully assess the potential impact of any rate adjustments on financial markets and the broader economy.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account