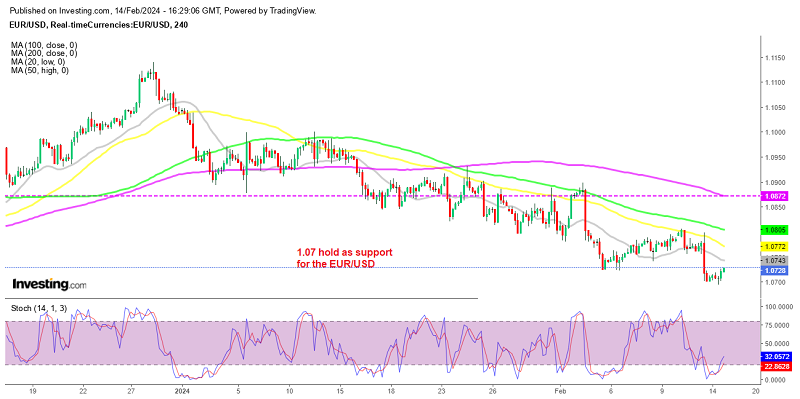

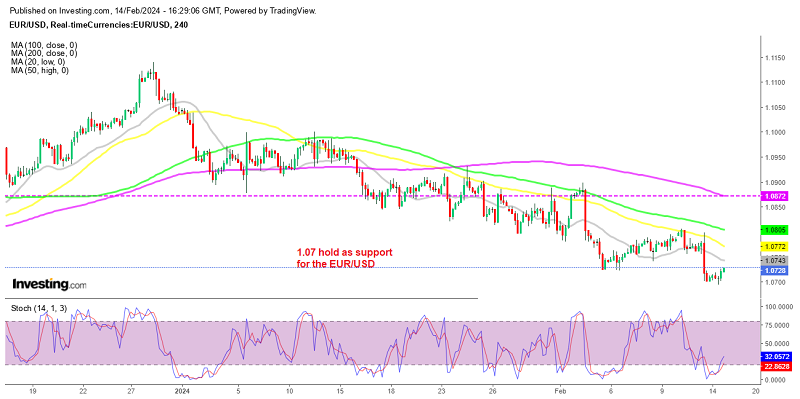

1.07 Holds in EURUSD With Eurozone GDP, Industrial Production Helping

The decline picked up momentum in EURUSD yesterday after the US CPI. But a support formed at 1.07 and Eurozone data is looking better today

The decline picked up momentum in EURUSD yesterday after the strong US CPI inflation numbers. But a support zone has formed here and today we’re seeing a slight reversal higher after some positive data from the Eurozone, such as the GDP report and the Industrial Production, which posted a strong jump in January.

Eurozone Flash Estimate GDP Report for Q4

- Eurozone Q4 2024 GDP Flash Estimate – 0.0% vs 0.0% expected

- First reading for Q4 GDP was 0.0%

- Previous (Q3) Eurozone GDP was -0.1%

This is not a great GDP reading, but it keeps the Eurozone economy out of a technical recession, which would have turned the sentiment bearish for the Euro. The industrial production data on the other hand, was quite strong and the USD is also retreating somewhat, so EUR/USD is around 30 pips above this support area now.

Eurozone industrial production for December posted a strong jump, posting a growth of 2.6% month-on-month (m/m) compared to the anticipated decline of 0.2%. This figure indicates a robust expansion in industrial output for the Eurozone during the month. Additionally, the industrial production data for November was revised higher, showing a positive growth of 0.4% compared to the previously reported decline of 0.3%. Overall, these numbers suggest a positive trend in industrial activity within the Eurozone, which could have implications for the region’s economic performance.

Eurozone January Industrial Production from Eurostat – 14 February 2024

- December industrial production +2.6% vs -0.2% m/m expected

- November industrial production -0.3%; revised to +0.4%

That’s a big jump in industrial output on the month but it comes with a bit of a caveat. Ireland saw a 23.5% jump in industrial output on the month so that is skewing the overall data slightly. Looking at the breakdown, the outlier there sees a 20.5% increase in capital goods on the month. Meanwhile, durable consumer goods (+0.5%), energy (+0.3%) and non-durable consumer goods (+0.2%) also saw increases. The production for intermediate goods (-1.2%) was the only one to see a decline.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account