GBP/USD Price Forecast: Eyes on UK GDP and US Retail Sales Today

The Sterling trades cautiously above 1.2550 in the early Asian session on Thursday, rebounding slightly from a trough of 1.2520. The rebound

The Sterling trades cautiously above 1.2550 in the early Asian session on Thursday, rebounding slightly from a trough of 1.2520. The rebound, however, may have its wings clipped by the latest UK inflation figures, which came in softer than anticipated.

With the UK’s Q4 GDP growth figures on the horizon, traders are positioned for new cues. Currently, the GBP/USD pair trades at 1.2562, experiencing minimal movement within the last 24 hours.

Inflation Data and Central Bank Policies

Last week’s US inflation figures, which overshot expectations, have recalibrated market expectations around the Federal Reserve’s inflation trajectory, hinting at a protracted journey toward normalization. Fed Vice Chair Michael Barr has expressed confidence in returning to the 2% inflation target but underscores the importance of continued positive data before pivoting towards rate reductions.

In contrast, the UK’s inflation landscape paints a different picture. January’s CPI year-on-year increase was only 4%, shy of the 4.2% forecast.

On a monthly basis, there was a 0.6% decline from the previous month’s increase. Core CPI, which strips out the volatile food and energy segments, saw a year-on-year rise of 5.1% in January, just under the 5.2% consensus.

BoE’s Stance and Market Reactions

Governor Andrew Bailey of the Bank of England acknowledged the subdued inflation data, suggesting the central bank’s inflation targets are still on track and projecting a return to target levels by spring.

Market sentiment has adjusted accordingly, with the probability of a BoE rate cut to 5.0% in June now standing at nearly 40%, a decrease from the 60% likelihood before the impactful US inflation data.

Anticipated Economic Indicators

As markets await the UK’s Q4 GDP, expected to show a modest 0.1% year-on-year expansion, attention will also be given to industrial production and trade balance data. The US slate is full, too, with Retail Sales, Philly Fed Manufacturing Index, Industrial Production, and Initial Jobless Claims due for release.

In the UK, a slew of indicators will provide further clarity on the economic direction: GDP is anticipated to show a month-on-month contraction of 0.2%, with preliminary Q4 figures expected to mirror this downtrend. The Goods Trade Balance forecast suggests a slight improvement, while Industrial and Manufacturing Production might offer a glimmer of hope with predicted upticks.

The US will focus on core retail sales and manufacturing indices, which may signal shifts in consumer behavior and industrial strength, respectively. Unemployment claims are predicted to remain stable, offering a snapshot of the job market’s resilience.

With these impending data releases, investors will be parsing through the details to gauge the health of both economies, potentially setting the stage for the next moves in GBP/USD.

GBP/USD Price Forecast: Technical Outlook

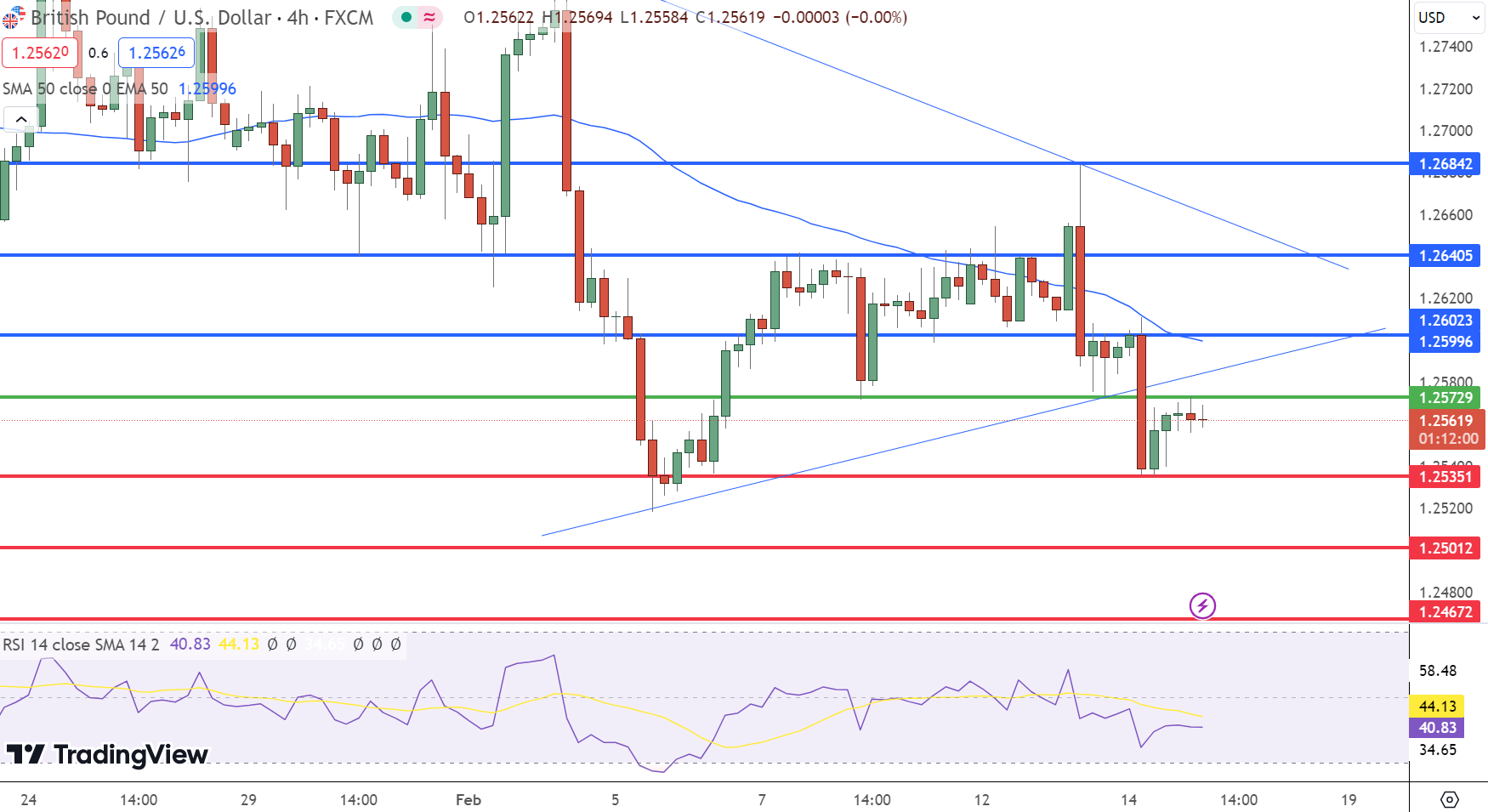

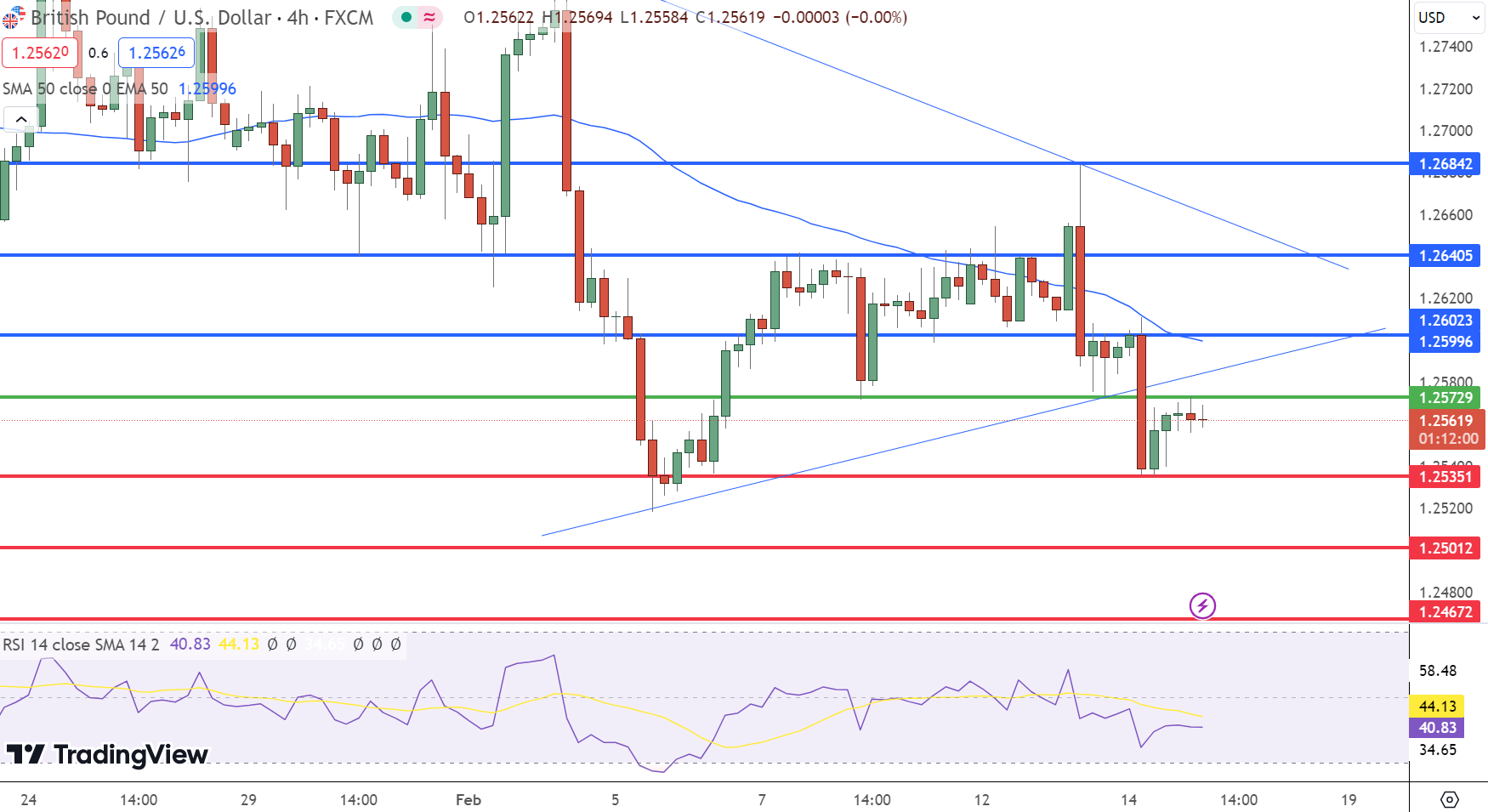

Our technical analysis identifies a pivot point at 1.2573, with immediate resistance levels at 1.2602, 1.2641, and 1.2684. Conversely, support levels are established at 1.2535, 1.2501, and 1.2467.

The Relative Strength Index (RSI) is 40, indicating a tilt towards selling pressure. At the same time, the 50-day Exponential Moving Average (EMA) stands at 1.2600, hovering above the current price, reinforcing the potential for a downtrend continuation.

Notably, an upward trendline breakout at the 1.2572 level suggests an intensifying selling trend. The GBP/USD has retested a previously breached support level, acting as resistance. The 50 EMA and RSI align, pointing towards a selling bias.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account