Canada Producer Inflation PPI Keeps Falling, Helping Lower Consumer Inflation

The USD to CAD exchange rate has been moving higher as inflation slows in Canada, with PPI Inflation helping along.

The USD to CAD exchange rate has been moving higher as inflation slows in Canada, with PPI Inflation helping along. Today’s PPI (Producer Price Index) showed yet another decline in January, which is likely going to impact the CPI (Consumer Price Index) for February.

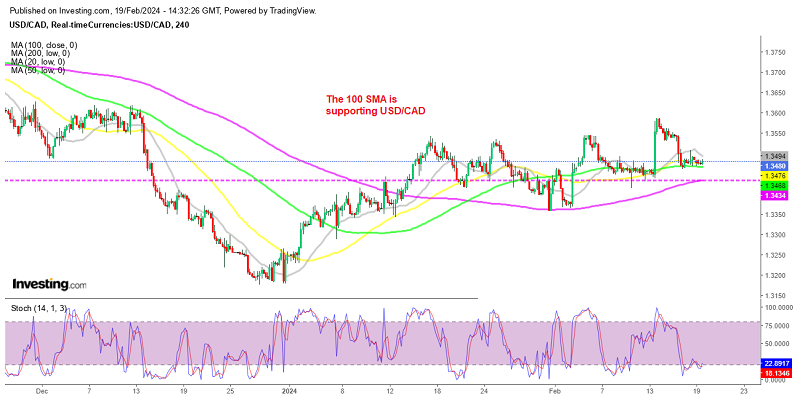

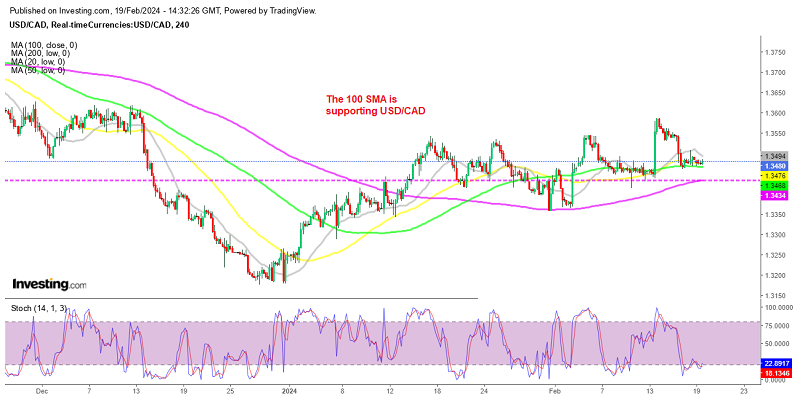

USD/CAD was heading to 1.36 last week after the strong US CPI inflation, but reversed back down and has encountered difficulty surpassing the 1.350 level, which has formed a resistance zone, trading within a sideways range in recent sessions. Market participants are awaiting a positive catalyst to propel the price above this level, signaling the continuation of the primary bullish trend visible on the chart. But it will have to come from the USD side, because the news from Canada is not moving the market too much. It’s worth noting that the next major target is situated at 1.3600.

Canadian January 2024 producer price index data

- January PPI -0.1% vs -0.1% expected

- Prior was -1.5% MoM

- Prices -2.9% YoY vs -2.7% prior

- Raw materials prices +1.2% MoM vs -4.9% prior

- Raw materials prices -6.4% YoY vs -7.9% prior

In January 2024, the Canadian Producer Price Index (PPI) experienced a slight decline of -0.1%, the same as the expected decrease of 0.1%. This marks a change from the previous month, which saw a larger decline of -1.5%. Year-on-year, prices have increased the pace of decline at -2.9%, compared to the previous reading of -2.7%.

However, there was an increase in raw material prices, rising by 1.2% month-on-month, in contrast to the previous month’s decline of 4.9%. Year-on-year, raw material costs were down by 6.4%, showing an improvement from the previous reading of -7.9%. This helps to address consumer inflationary pressures. However, we must also monitor crude Oil prices, which are showing signs of increasing.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account