CAD Tumbles As Inflation Falls in Canada

Canada CPI YoY slowed from 3.4% to 2.9% while CPI MoM fell flat at 0.0%. The CAD to USD rate jumped 50 pips higher

The US and Canada return from the bank holiday weekend today with inflation coming out from Canada earlier toda. Market forecasts were for a 3.3% year-on-year inflation and 0.4% month-on-month increase in January CPI, however we saw a decline in both numbers.

While core numbers in the previous month’s report were generally higher, the overall trend has shown improvement. The market was pricing in a 20% likelihood of a rate cut at the Bank of Canada (BOC) March meeting, gradually increasing to a full rate cut being factored in by July. But, we saw a larger slowdown today, with Canada CPI YoY falling from 3.4% to 2.9% while CPI MoM fell flat at 0.0%, which sent the CAD lower across the board, with the USD to CAD rate jumping 50 pips higher.

Canadian January 2024 Inflation Report

- Canada’s January CPI Yoy came in at 2.9% year-on-year, below the expected 3.3%

- January CPI reading YoY was 3.4%.

- The month-on-month CPI remained unchanged at 0.0%, falling short of the expected 0.4% increase.

Core measures of CPI also showed some moderation:

- CPI Bank of Canada core year-on-year: 2.4% compared to the previous 2.6%

- CPI Bank of Canada core month-on-month: +0.1% versus the prior -0.5%

- Core CPI month-on-month seasonally adjusted: -0.1% compared to the previous +0.1%

- Trimmed meand inflation: 3.4% versus the prior 3.7%

- Median inflation: 3.3% versus the prior 3.6%

- Common inflation: 3.4% versus the prior 3.9%

The headline CPI figure for Canada received a boost from a strong January 2023 reading, while the core CPI showed the opposite trend. However, there may be some support on both fronts starting in February, which could accelerate declines. Despite this, the Canadian dollar weakened across the board even without support. With this development, the Bank of Canada may have more leeway to cut rates sooner rather than later.

They may not hesitate to act if they are prudent. Market pricing for March has increased to 27% from 19% following the report, and year-end pricing stands at 76 bps compared to 64 bps prior to the release. Specifically, in January, CPI decreased by 4.0%, primarily due to declines in airfares (-14.3% month-on-month) and travel tours. Additionally, the cost of cell phones decreased year-over-year.

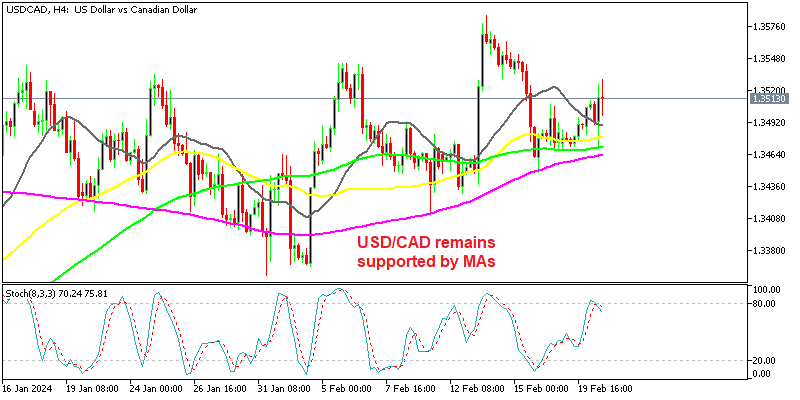

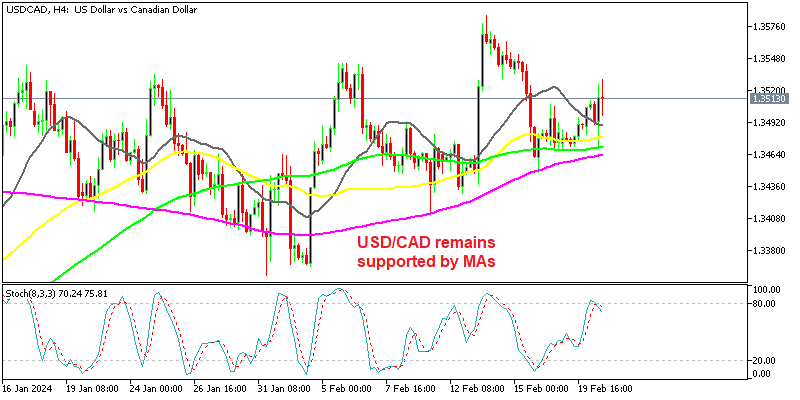

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account