GBP Steady, as Bank of England Starts to Accept the Economic Slump

The Bank of England is finally accepting the UK consumer is suffering, but GBP/USD holds steady

GBP/USD has been holding pretty well so far in 2023, despite the USD strength witnessed in January, as the Bank of England held the policy steady. But they are accepting the difficult position that the UK economy is in, with several BOE members confirming that this week. Nonetheless, the GBP to USD ratio remains stable ahead of the FOMC minutes which will be released later today.

BOE Dhingra Comments Today

Dhingra of the Bank of England highlighted that, unlike the United States and the eurozone, UK consumption levels remain below pre-pandemic levels. She emphasized the potential risks associated with overtightening monetary policy, noting that it could lead to hard landings and leave lasting scars on supply capacity.

Given the uncertainties and challenges ahead, Dhingra stressed the importance of taking a cautious approach to determining the appropriate level of the bank rate in the medium term. While headline inflation forecasts may be volatile, there are indications of a downward trend.

Dhingra underscored the need for forward-looking monetary policy, as the effects of policy adjustments take time to materialize in the real economy. He expressed confidence that inflation is on a path toward achieving the bank’s medium-term goal in a sustainable manner, based on observed price changes.

BOE Governor Bailey’s Comments Yesterday

Governor Andrew Bailey’s emphasis on seeking longer-term progress in addressing enduring components of inflation suggests a cautious approach to monetary policy, prioritizing sustained economic stability over short-term fluctuations. Additionally, his observation regarding slowing pay growth in line with decreasing headline inflation underscores the complex interplay between various economic indicators.

Bailey’s remarks indicate that the Bank of England’s current policy stance of maintaining interest rates at their current level remains unchanged for the time being. However, he also acknowledges potential challenges to this narrative, suggesting that there may be significant caveats in the latest UK employment market report that warrant further consideration and analysis. Overall, Bailey’s statements reflect a nuanced understanding of the economic landscape and the need for careful evaluation of multiple factors before making any adjustments to monetary policy.

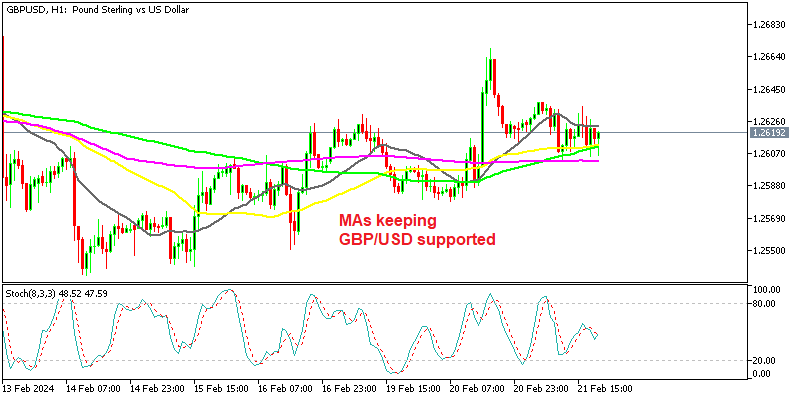

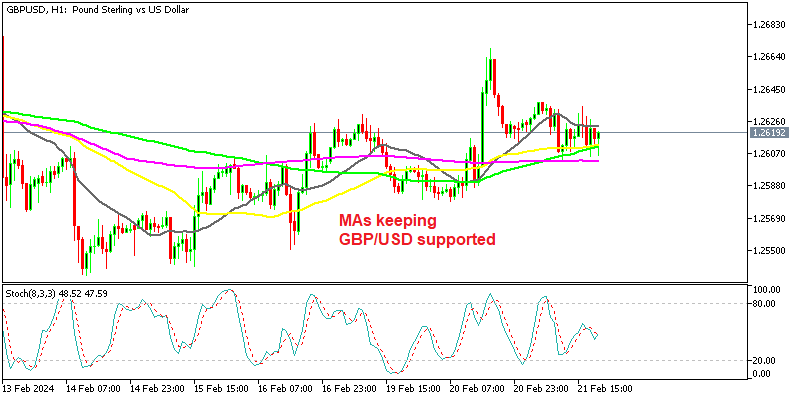

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account