Experts Believe The Fed Will Cut Before the RBA!

During the Meeting Minutes, representatives expressed greater concern about the lingering risks associated with a premature rate decrease compared to a prolonged period of elevated interest rates. In light of this, markets are reassessing the potential timing for a relaxation of the regulator’s stance in May and June. As per the CME Group’s FedWatch Tool, the probability of an adjustment in May is currently estimated to be between 30% and 35%. Anything exceeding the 70% threshold is viewed as highly probable.

The upcoming Core PCE Price Index report holds significant importance for the Dollar, serving as the final inflation indicator for both the current month and the near future. Should the PCE Price Index register a further increase, it would signify that all five inflation metrics have surpassed expectations. Consequently, the Dollar could see an uptick. Nevertheless, the Dollar faces challenges due to the elevated risk appetite in the market, with many anticipating a pre-emptive cut by the Fed. Consequently, the Dollar’s performance may remain under pressure unless other central banks adopt a more dovish stance.

Although the interest rate set by the Reserve Bank of Australia is lower than that of the Fed, analysts anticipate the Fed to implement the initial rate cut. Despite Australia experiencing a slowdown in GDP growth, its economy remains more robust than those of Europe and the UK. Additionally, inflation remains above 4.00%, which is notably high for the Australian dollar, while analysts assess the current unemployment rate of 4.1% as manageable. Consequently, the majority of analysts predict the RBA to lower rates in the third quarter, following the Fed’s lead. Hence, fundamental analysis slightly favors the Australian dollar in this scenario, although ongoing positive indications from technical analysis are necessary to confirm an upward trend.

Yesterday Australia confirmed that wages increased by 0.9% during the past quarter, meeting expert expectations but mainly higher than the RBA would like, and amounted to 4.2% yearly, exceeding 4.1% estimates. Therefore the pace of salary increases surpassing the current inflation rate of 4.1%.

It is vital for traders to analyse the AUDUSD as a signal asset, but equally important to also analyse as individual currencies. The US Dollar Index, which includes 6 currencies, has fallen 0.55% this week and trades at a 3-week low. The weakness in the Dollar is partially due to high-risk appetite and a lower demand for the safe haven asset.

The AUD on the other hand is witnessing mainly upward price movements depending on the currency pair. The Australian Dollar is increasing against the GBP, Euro, Yen, and the CHF but is declining against the NZD. So here we can see there are no major conflicts between the two individual currencies. However, investors will need to continue monitoring the US Dollar Index and price condition of the AUD against other major currencies.

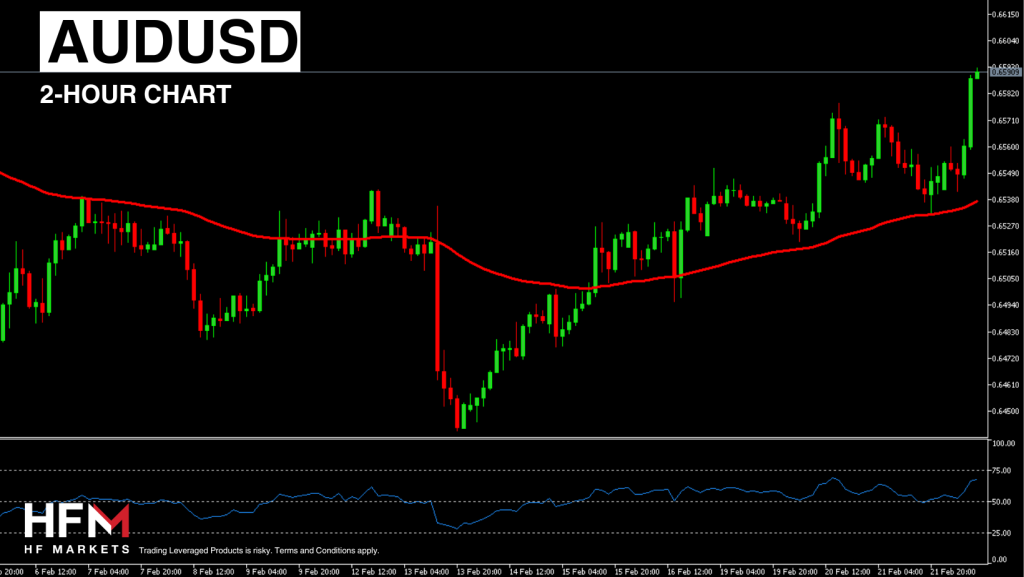

The AUDUSD is trading above the 75-Bar Exponential Moving Average and above the “Neutral” level on the RSI as well as the Bollinger Bands. These three factors indicate a further bullish trend as the asset is yet to be read “overbought” on most oscillators. In addition to this, the asset has managed to break above the resistance level and the previous high, meaning the continuation of the traditional wave pattern.

The only negative indication when evaluating technical analysis is the measurements of the previous 4 impulse waves. The average bullish wave size is 0.87% and the largest has been 0.92%. The current impulse wave reads 0.87%. Therefore, if the pattern is to continue the price may retrace soon, even if it is going to continue rising thereafter. However, this cannot be known for sure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account