Euro Fails at the 50 SMA Again After ECB Lagarde Comments

The Euro to dollar rate continues to fluctuate between 1.08 and 1.09. EURUSD experienced subdued price action today, with a 30 pip range

The Euro to dollar rate continues to fluctuate between 1.08 and 1.09. The currency markets experienced subdued movement today, with the range in EUR/USD being 30 pips major from top to bottom, while other currencies continue their downward trend amid relative calm. The dollar saw a slight decline overall, while movements in stocks and bonds remained modest.

In addition, ECB policymakers continued to resist market expectations, urging caution and advocating for waiting until the release of the next set of wage data in May before potentially implementing the first rate cut in June. However, markets are not reacting much to this news today, as traders head out for the weekend.

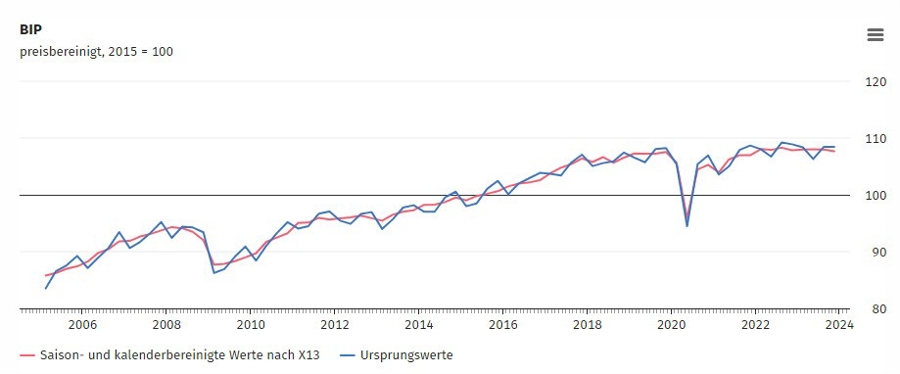

Economic data today painted a picture of sluggishness in the eurozone’s largest economy, with the German Ifo business survey indicating tepid sentiment. Additionally, the final GDP estimate confirmed Germany’s technical recession during the second half of last year. ECB policymakers reiterated their stance, urging markets to defer rate cuts until after the release of the next round of wage data in May.

EUR/USD Chart – H4 Timeframe

ECB Lagarde Comments

The significance of positive Q1 2024 results hinges on providing further assurance that deflationary trends are sustainable. Notably, the European Central Bank (ECB) appears intent on delaying action until May, aligning with previous comments made by ECB member Nagel. She added that the ECB’s approach seems independent of the actions taken by other central banks, underscoring its focus on domestic economic indicators and wage data expected in the coming months.

Germany Q4 final GDP Released by Destatis – 23 February 2024![DEGDP]()

- Germany Q4 final GDP QoQ -0.3% vs -0.3% prelim

- Q3 final GDP was -0.1%

German February Ifo Business Climate Index

- Germany February Ifo business climate index 85.5 points vs 85.5 points expected

- January Ifo business climate index was 85.2 points

- Current conditions 86.9 points vs 86.7 points expected

- Prior current conditions were 87.0 points; revised to 86.9 points

- Expectations 84.1 points vs 84.0 points expected

- Prior expectations were 83.5 points

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account