NZDUSD Stays Close to 0.62 as NZ Q4 Retail Sales Fall

The NZD to USD exchange rate increased above 0.62 this week as the price broke above the resistance and the 50-daily SMA in NZD/USD. But, buyers are not running away and the New Zealand dollar is staying close to these major levels, considering that the retail sales for Q4 which was released last night showed a major decline of 1.9%.

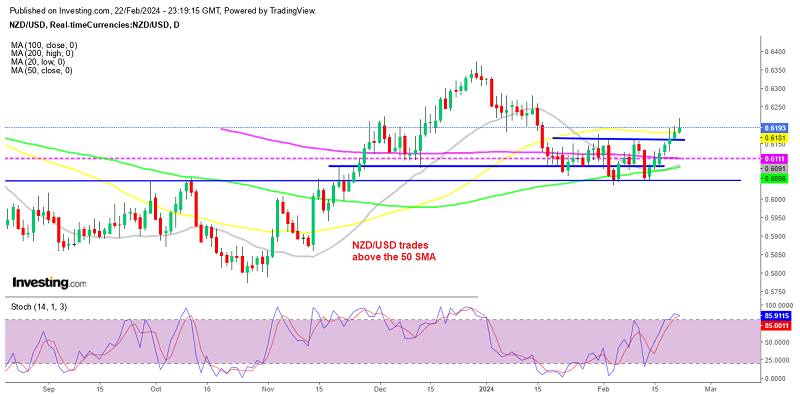

NZD/USD Technical Analysis – Daily Chart

NZD/USD was fluctuating in a 120 pip range, with resistance around 0.6160-70 for about a month, however, buyers broke through the resistance this week and they also pushed the price above the 50 daily SMA (yellow). But, the price is not running away and is staying close to the 50 SMA, with retail sales posting a major decline in Q4 of last year, as shown below.

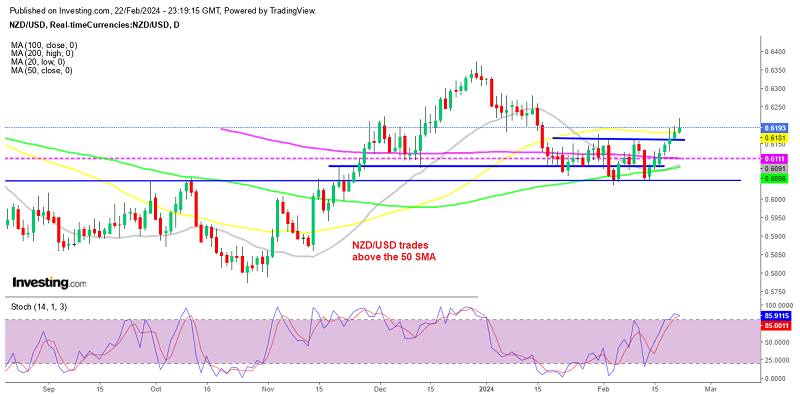

January Retail Sales

New Zealand’s retail sales for the fourth quarter experienced a significant decline, coming in at -1.9% compared to the expected -0.2%. This figure indicates a sharp downturn from the previous quarter, which saw no growth. The retail sales volume for the quarter also reflected the same trend, declining by -1.9% compared to the expected -0.2%. This result was much weaker than anticipated, highlighting a notable contraction in consumer spending during the period.

On a year-over-year basis, the retail sales for the fourth quarter showed a decrease of -4.1%, compared to the -3.4% recorded in the previous quarter. This suggests a continued downward trend in retail sales over the past year. Overall, these figures indicate a significant weakening in consumer activity and retail sales performance in New Zealand during the fourth quarter, falling well below market expectations.

Reserve Bank of New Zealand Remains More Hawkish Than the FED

At its recent meeting, the Reserve Bank of New Zealand (RBNZ) opted to keep its official cash rate unchanged, maintaining a patient stance amidst ongoing moderation in demand growth. The central bank highlighted that this trend is expected to persist as long as monetary conditions remain tight. The RBNZ’s decision to hold rates steady is further supported by inflation statistics in New Zealand, which were in line with forecasts.

Additionally, labor market data surpassed expectations, with a decrease in the unemployment rate and a notable increase in wages. While the Services Purchasing Managers’ Index (PMI) rebounded into expansion territory in January, indicating growth in the services sector, the Manufacturing PMI continued to decline, suggesting ongoing challenges in the manufacturing industry. Looking ahead, market expectations point toward a potential rate cut in August, reflecting anticipation for further monetary policy adjustments to support economic conditions in New Zealand.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account